- Sporting Crypto

- Posts

- 2026 Predictions

2026 Predictions

2025 was a mixed year for sports and blockchain. But we're set up for a fascinating 2026. Read my 2025 predictions review, and my 2026 predictions in this piece.

Join 5000+ Leaders in Blockchain & Sports from brands like FIFA, NBA, Premier League, NHL, reading Sporting Crypto every week 👇️

👥🔍 Sporting Crypto Job Board - Jobs of the week

Head of B2B Sales @ Sweat Foundation - Link here

Growth Product Manager @ Courtyard.io - Link here

Design Engineer @ Dapper Labs - Link here

Visit the Sporting Crypto Job Board today to explore new career opportunities or to find the perfect fit for your organisation.

Discussed in this edition of Sporting Crypto:

1) 2025 Prediction Review ⌛️

2) 2026 Predictions 🔮

Happy New Year 👋

In this piece, I’ll review my 2025 predictions and then provide my 2026 ones.

This year promises to be a big one for two industries that show no signs of slowing down.

P.S. If we haven’t connected before, and you want to, reply to this newsletter and let’s chat

Let’s kick off with a review of my 2025 predictions, and to be honest… there isn’t that much to write home about. However, some of my more speculative predictions do look directionally pretty good… which means I’ll make it my aim to make them much punchier this year.

2025 Prediction Review ⌛️

1) Web3 Gaming Takes a Bigger Leap

The prediction: Up first — the easiest prediction of them all is that Web3 gaming will take an even bigger leap in 2025. This is cheating to some extent… we know that FIFA and Mythical Games are launching FIFA Rivals at some point in 2025.

The rating: 5/10

Why: It was an AWFUL year for Web3 gaming. But relatively speaking, sports stood strong. FIFA Rivals did launch and has been super successful, hitting 1 million downloads within 7 weeks of launch.

2) Real World Assets Onchain Get More Sporty

The Prediction: The two key areas that I see being disrupted here in 2025 in a big way are:

Memorabilia, which we're already seeing with the likes of courtyard.io

Ownership in the teams themselves

The Rating: 7/10

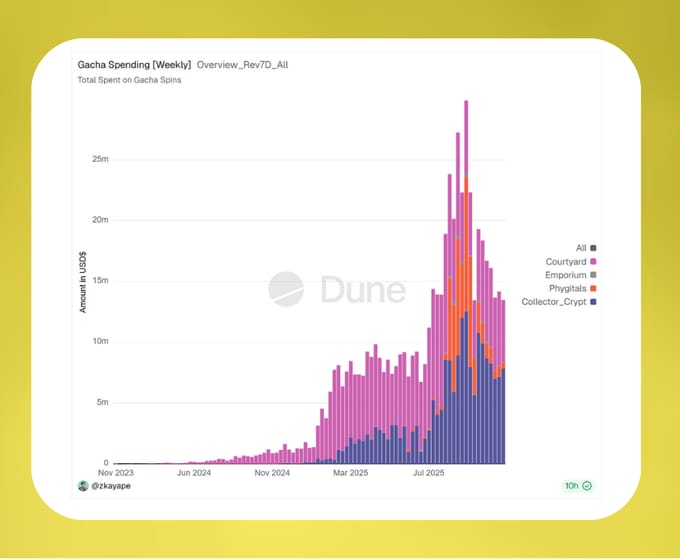

Why: So Courtyard had an absurdly successful year in 2025, and other companies in the memorabilia space such Collectors Crypto have done really well. On the other hand, following Watford FC’s onchain equity raise in 2024 — we haven’t seen that much in sports on that end. But, this does come within the context of onchain stocks hitting $1.2bn in volume recently, so perhaps the onchain equity financing model for sports teams will become more prevalent sooner, rather than later.

3) Regulatory Clarity Provides Sports Teams with a Path Forward in Web3

The Prediction: This is probably the most important thing that will happen in 2025. A lot of sports teams and leagues have wanted to do stuff in this space, but have been stopped in their tracks by regulatory uncertainty. I think that globally, we're going to be in a much better space in 2025 when it comes to how comfortable sports teams and leagues are in taking risks here.

The Rating: 7.5/10

Why: This was the most conservative prediction, but the reason it can’t be higher than a 7.5/10 is that we mostly saw this reflected in sponsorships rather than sports teams or brands building and rooting blockchain into their tech stacks.

4) Sports Web3 Market Consolidation

The Prediction: I think 2025 will be a big year for M&A in the sports and Web3 space. While the number of pure-play sports Web3 businesses is limited, we'll see opportunities emerge as performance gaps widen between companies.

The Rating: 6/10

Why: UpTop were acquired by Rain towards the end of the year, which probably brings me to 6/10 here, and we saw a lot of prediction market-related acquisitions. But if you took prediction markets out of the frame, this was nearly a pretty poor prediction (no pun intended).

5) A Sports Team Integrates Blockchain Directly into Its Fan Engagement App

So far, we have seen many sports teams and leagues create separate apps for Web3 fan engagement applications. This makes sense. They can silo the risk. They can silo the tech. To maximise the value of what can happen in this intersection, sports teams and leagues have to integrate directly.

The rating: 2/10

Why: I feel this was sooooo close to coming to fruition, and will happen in 2026 just in a different way — which I will get into in part 2 of this newsletter.

6) Web3 Loyalty Makes a Comeback

The Prediction: With Nike, Starbucks and many other big brands shuttering their Web3 loyalty applications and programmes, many think this space is dead. However, we have seen green shoots in late 2024 that suggest Web3 loyalty could make a big comeback in 2025, particularly in sports.

The Rating: 5/10

Why: UpTop expanded their customer base, adding the Pistons and LSU Athletics to their roster of clients. Barcelona launched an onchain loyalty program, but their vendor in Futureverse went into receivership, so nobody knows where that will go. Red Bull Racing launched a free-to-claim onchain loyalty product, which saw great numbers. But we’re yet to see something mainstream that is integrated directly into existing tech stacks. I think that could change in 2026.

7) Nike's Competitors Take Advantage of Their Web3 Withdrawal

The Prediction: Nike have seemingly left the Web3 space and are now looking to go back to their roots of wholesale distribution and brand marketing. However, I think their competitors, such as Adidas, ASICS, Puma, Reebok and others are still here to stay on the Web3 front.

The Rating: 0/10

Why: This just didn’t happen.

8) Blockchain Ticketing Finally Makes the Leap

The Prediction: While this is a longer-term play, and I'm not necessarily hanging my hat on this happening in 2025, the continued presence of funding and smart builders in this space suggests blockchain ticketing might finally make a dent on the traditional oligopolies this year.

The Rating: 2.5/10

Why: We saw sprinkles of announcements, rumours that Live Nation may be forced to dismantle their monopoly as well as the NFL looking at taking their ticketing in-house. But not enough to warrant more than a 2.5.

9) Crypto[dot]com Try to Buy a Sports Team

The Prediction: Crypto[dot]com tries to buy a sports team. With their massive sponsorship spending in Sport and the recent launch of a sports predictions market (a first for crypto exchanges), this business might be gearing up for something bigger. It might not be Crypto[dot]com specifically - we've seen Tether invest in a video platform Rumble recently, and there are other crypto companies, blockchains and exchanges flush with cash — that may take their investing beyond tech. The opportunity to take a huge loyal audience and put everything onchain - from data to ticketing to player contracts - could be compelling for a crypto business with deep pockets.

The Rating: 10/10

Why: This was my most speculative prediction, and 3 months before Tether’s 5% stake acquisition in Juventus… and eventual bid to take over the entire club. Because of how out there it was, I’m going to give myself a 10/10. Ironically, this was probably my best prediction?

2026 Predictions 🔮

Onto my 2026 predictions…

1) FIFA launch a token before the World Cup, and Donald Trump or an affiliated company holds a big portion of the supply

There have been hints, murmurs and indications that FIFA will launch a crypto token at some point. Indeed, FIFA president Gianni Infantino was strangely present at the White House Digital Summit last year, where Donald Trump said, "It could be quite a coin. That coin could be [worth] more than FIFA."

At the end of 2025, Donald Trump was then awarded the Inaugural FIFA Peace Prize, controversial for many.

With the World Cup 2026 being hosted in North America, it feels like there is more brewing between FIFA and the crypto progressive Trump regime. I think that may end up with a FIFA token in 2026.

2) Tether acquire Juventus and settles a transfer in summer 2026 using their USDT stablecoin

Tether have already had a $1.3bn all-cash offer for Exor’s ~65% ownership stake in Juventus FC rebuffed. But money talks, and everything has a price, no matter what Exor’s positioning is publicly. Juventus have flatlined from a revenue perspective in the last 5 years, and relative to competitors such as AC Milan and Inter Milan, it doesn’t look good.

3) A Sports team or brand tokenize their loyalty program

Tokenized loyalty is going to have a renaissance. That feels obvious now that crypto-based payment rails have matured. There are also longer-term, successful proof points in the market — mainly from UpTop — who have now been acquired by Rain. And I think this year we’ll see it integrate into existing tech stacks, or migrations to new blockchain enabled ones.

4) Fanatics or an equivalent type of business attempts to acquire Sorare

Stab in the dark — but Fantatics is the sports and culture everything company that went all in on gambling and prediction markets in the previous 18 months. 2026 is going to be big for prediction markets, but at some point, user churn is going to be painful for these businesses, especially those that focus solely on sports.

Sorare have struggled to reach the heady heights of 2021 once more, and their recent numbers suggest they are looking to either raise once more or sell the business. Let’s see if that happens post World Cup, for which I’m sure they will push hard, and then into the new football season 2026/27.

5) Kalshi’s dominance in sports prediction markets drops

Short term, this is going to look like a dumb prediction, but by the end of 2026, I expect there to be so much competition in the sports prediction market space from crypto exchanges, sportsbooks and brokerages that Kalshi eventually see a drop both in 1) The % of their total volume being sports and 2) The total % of the sports market they dominate.

6) Robinhood try to buy a crypto exchange, prediction market product or onchain collectibles platform, citing sports event contracts or cultural assets as the reason

Robinhood have already gone hard at prediction markets and also onchain stocks. They want to be the everything app for everything that can be financialised. I think they will double down on prediction markets, but it can’t be long before they look at other assets that are usually illiquid. Private stocks are just the start. Collectibles, art, cars, sports teams — I think we’re going to see illiquid assets go onchain and increase liquidity. Robinhood feels like the place where this could live short-term?

More Sports & Web3 Stories

Nike quietely sold off RTFKT at the end of 2025 (Read more here)

Bitpanda become the official trading partner of Haknenkamm Races (Read more here)

MMA Partners with World Liberty Financial to Build Global Token Economy in Combat Sports (Read more here)

Tennessee orders Kalshi, Polymarket and Crypto[dot]com to cease sports betting contracts (Read more here)

General ‘Stuff’ that Could Impact You

Thanks for reading the latest edition of the Sporting Crypto newsletter!

If you enjoyed this, please tell your friends who might be interested and share it on socials.

Disclaimers

This newsletter is for informational purposes only and is not financial, business or legal advice. These are the author’s thoughts & opinions and do not represent the opinions of any other person, business, entity or sponsor. Any companies or projects mentioned are for illustrative purposes unless specified.

The contents of this newsletter should not be used in any public or private domain without the express permission of the author.

The contents of this newsletter should not be used for any commercial activity, for example - research report, consultancy activity, or paywalled article without the express permission of the author.

Please note, the services and products advertised by our sponsors (by use of terminology such as but not limited to; supported by, sponsored by or brought to you by) in this newsletter carry inherent risks and should not be regarded as completely safe or risk-free. Third-party entities provide these services and products, and we do not control, endorse, or guarantee the accuracy, efficacy, or safety of their offerings.

It's crucial to provide our readers with clear information regarding the inherent nature of services and products that might be covered in this newsletter, including those advertised by our sponsors from time to time. When you buy cryptoassets (including NFTs) your capital is at risk. Risks associated with cryptoassets include price volatility, loss of capital (the value of your cryptoassets could drop to zero), complexity, lack of regulation and lack of protection. Most service providers operating in the cryptoasset industry do not currently operate in a regulated industry. Therefore, please be aware that when you buy cryptoassets, you are not protected under financial compensation schemes and protections typically afforded to investors when dealing with regulated and authorised entities to operate as financial services firm.