- Sporting Crypto

- Posts

- Courtyard Raise $30m Series A

Courtyard Raise $30m Series A

The onchain collectibles marketplace have raised a Series A led by Forerunner. They are one of the fastest growing companies in the world by revenue.

Join 4500+ Leaders in Web3 & Sports from brands like FIFA, NBA, Premier League, NHL, reading Sporting Crypto every week 👇️

👥🔍 Sporting Crypto Job Board - Jobs of the week

Head of Product Design @ Courtyard.io - Link here

Senior Partnerships Manager @ OneFootball - Link here

Design Engineer @ Dapper Labs - Link here

Visit the Sporting Crypto Job Board today to explore new career opportunities or to find the perfect fit for your organisation.

Courtyard Raise $30m Series A

Discussed in this edition of Sporting Crypto:

Courtyard’s $30m Series A Raise 🎴

How Courtyard Works ⚖️

Recent Success 📈

Analysis 🧠

Concluding Thoughts 💭

👉️ If you haven’t already, be sure to subscribe to our Gaming sister brand Gaming Crypto here! 👈️

Courtyard’s $30m Series A Raise 🎴

Forerunner Ventures have led a $30m Series A in collectibles marketplace Courtyard.

They are one of the fastest growing companies on the planet, let alone in the collectibles or blockchain space.

In an article with Fortune, Le Jeune said they want to stay ahead of the market through a mix of hiring, paid marketing, and product category expansion. They are also looking to launch a mobile app and have recently launched a comic book offering, stretching their marketplace capabilities beyond trading cards.

In the interview, he said:

“We want to make sure we double down on the growth and capture the market as fast as possible”

How Courtyard Works ⚖️

Courtyard’s business model is simple, but mightily effective.

👉 Take physical memorabilia and put them on the blockchain

🃏 Issue NFTs on the front end that are tradable

📦 You can buy and rip packs digitally, and every item you get has a physical equivalent backing it

🔃 If you trade that NFT, the blockchain shows you no longer have ownership of the physical asset that underlies it

🎴 If you want to redeem the physical item, your NFT is burned, and you are shipped it

This is a business model innovation for the collectibles industry, which they doubled down on using digital repacking.

They do this via their digital vending machine system. It lets buyers experience the ‘ripping’ experience of buying a physical pack in the digital realm.

The best part is that, for the consumer, they are able to sell their cards back to Courtyard at 90% of market value. It’s a win-win, because Courtyard are always in need of more cards.

They act as a market-maker, creating liquidity for their buyers and letting them ‘exit’ unwanted cards.

This then allows Courtyard to resell those cards as part of a bundled pack, via the vending machine, once again.

It’s digital re-packing onchain, backed by the physical asset.

According to Le Jeune, “The same card is sold an average of eight times a month on the platform”.

The margin for Courtyard is not on the initial pack sale, it’s on the market making mechanism.

Recent Success 📈

In my podcast with Le Jeune, he said that Courtyard is now the “largest buyer of cards in the world right now” and that they are “buying millions of dollars of cards per week".

He also said that they are “probably the fastest growing company [or top five] in the world in terms of revenue”.

It’s difficult to validate the claim, but you wouldn’t bet against it considering the year-on-year growth.The numbers are truly remarkable.

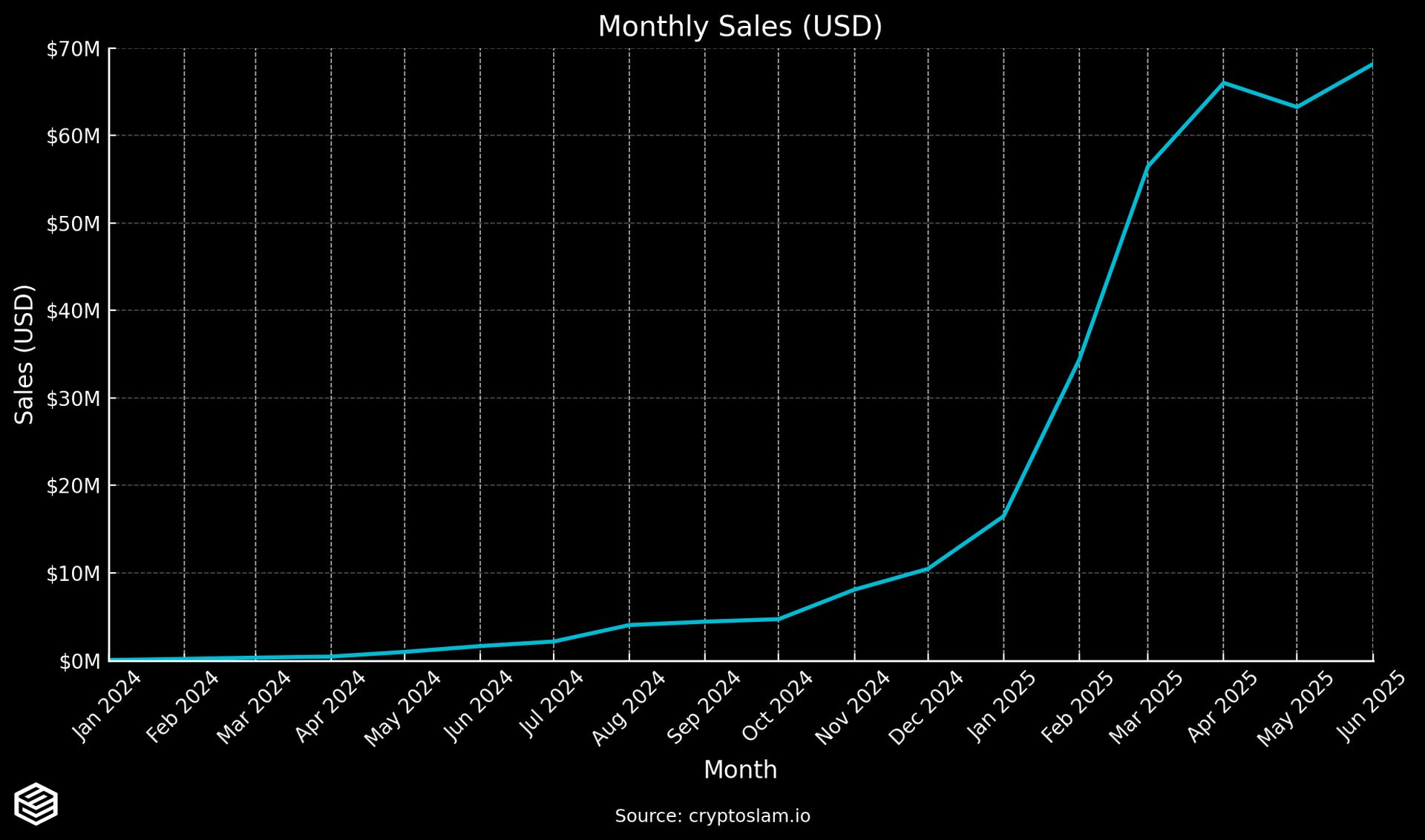

Here are their monthly sales volumes year-on-year:

Jan 2024: $53,000 ▶️ Jan 2025: $16.4m

Feb 2024: $184,000 ▶️ Feb 2025: $34.4m

March 2024: $325,000▶️ March 2025: $56.4m

April 2024: $449,000 ▶️ April 2025: $66m

May 2024: $979,000 ▶️ May 2025: $63.25m

June 2024: $1.6m ▶️ June 2025: $68.15m

Their exponential growth has seen them hit nearly $70m monthly sales volume in June 2025, which is extraordinary.

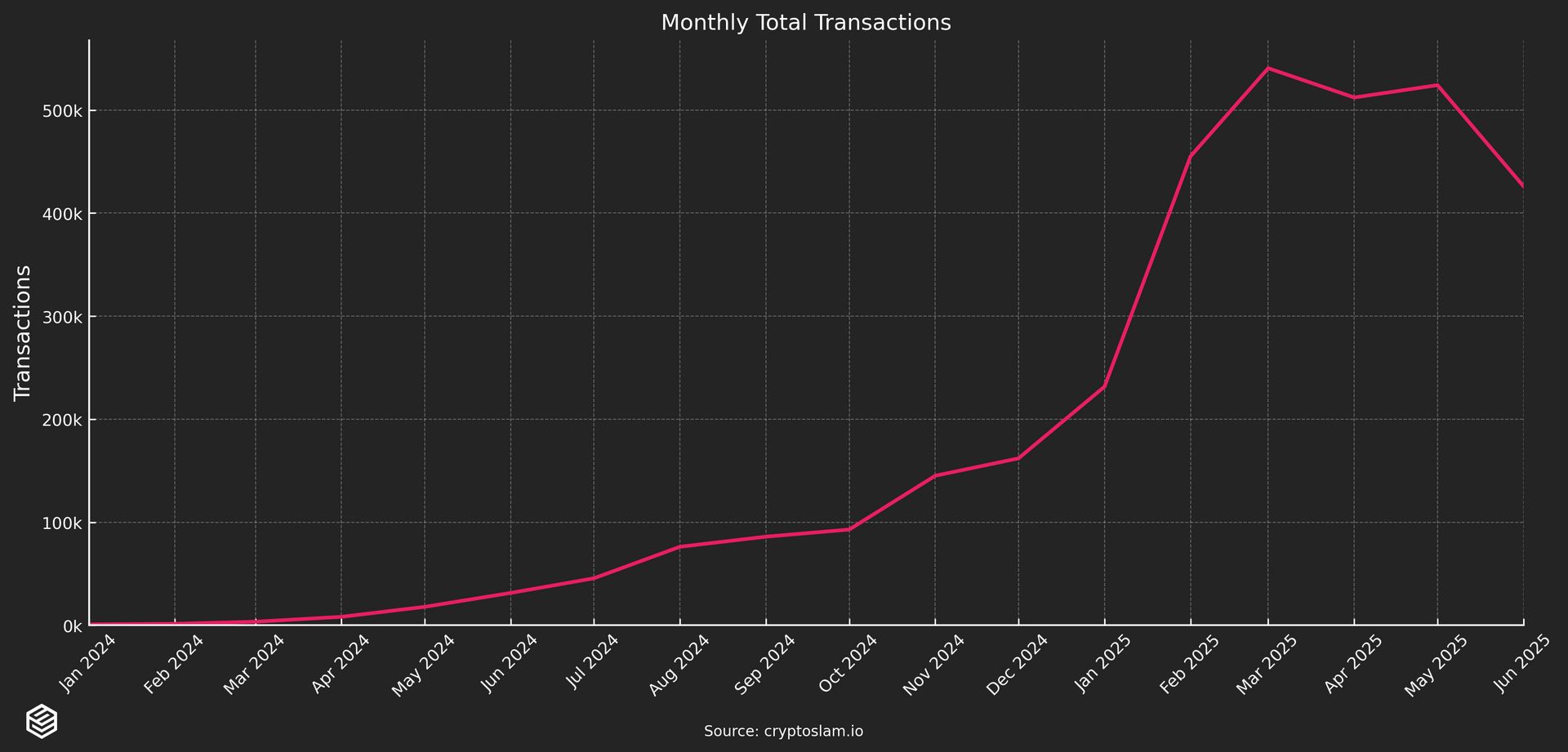

Total monthly transactions have also seen huge growth, from ~800 monthly transactions in Jan 2024 to over 500,000 in April 2025.

Analysis 🧠

This is a clear example of blockchain making a business model better, and there are numerous examples of why.

If we take a look at how memorabilia works currently, where you are physically packing something and sending it to another person in peer-to-peer marketplaces, there are limits to how big that market can become because of physical constraints.

To give you an example of the user flow: you buy something from eBay, there is a middleman who takes a fee, you could be defrauded, you might have to pay in another currency, and it could break or be stolen on the way to your buyer.

Then, when it arrives and you're thinking about whether or not to keep that piece of memorabilia, or sell it, that onerous process of holding the inventory and then eventually selling it again restarts.

Using the model that Courtyard have created:

Payments are faster, cross-border and settle instantly.

The transfer of ownership is instant.

The physical assets are vaulted by Courtyard.

There is more reselling of the same item in a period of time - as Le Jeune mentions, the same item is sold on average eight times per month.

They’ve created digital pack rips, but with the physical back end and a repacking mechanism.

This is a new business model.

Concluding Thoughts 💭

(1) Can Courtyard stave off competitors?

Courtyard will no doubt have competition from three sets of competitors:

Companies who are trying to completely replicate this model.

Incumbents who have physical marketplaces may look in this direction for the next innovation in their business model.

IP led pure digital plays (think Disney digital pins and Pokemon TCG pocket).

(2) They are no longer competing with blockchain companies

With that in mind, they are no longer competing with blockchain companies. Courtyard have gotten to the size where they are no longer competing with blockchain-based collectible businesses, but all collectible businesses.

(3) Will they ever face regulatory scrutiny?

We've seen EA’s Ultimate Team come under scrutiny from a litany of regulators, so that risk remains open for a company like Courtyard.

(4) This is one of the best examples of blockchain being used

Courtyard have made an existing business model more efficient.

They’ve overlaid that with a digital repacking model. Backed by physical assets. Secured by blockchain.

It’s innovation, with the re-invention of a business model layered on top of it.

As Le Jeune puts it: "We have a rare opportunity of doing something that a lot of companies have tried to do for a while, which is providing liquid market for illiquid assets.”

(5) Is the mobile app an inflection point or add on?

All of Courtyard’s growth so far has been browser native.

It will be interesting to see what their mobile app looks like, and whether it is skinned in a way to make it feel less like trading collectibles, and more like a discovery tool.

(6) How far can this go?

Le Jeune told me that they are “excited to build the next foundation of what we believe is going to be the next version of commerce."

That’s bold. But it’s difficult to bet against Courtyard. They have created price sensitivity for very illiquid assets. And there’s no telling how far reaching that can become.

More Sports & Web3 Stories

General ‘Stuff’ that Could Impact You

Thanks for reading the latest edition of the Sporting Crypto newsletter!

If you enjoyed this, please tell your friends who might be interested, and share it on socials.

Disclaimers

This newsletter is for informational purposes only and is not financial, business or legal advice. These are the author’s thoughts & opinions and do not represent the opinions of any other person, business, entity or sponsor. Any companies or projects mentioned are for illustrative purposes unless specified.

The contents of this newsletter should not be used in any public or private domain without the express permission of the author.

The contents of this newsletter should not be used for any commercial activity, for example - research report, consultancy activity, or paywalled article without the express permission of the author.

Please note, the services and products advertised by our sponsors (by use of terminology such as but not limited to; supported by, sponsored by or brought to you by) in this newsletter carry inherent risks and should not be regarded as completely safe or risk-free. Third-party entities provide these services and products, and we do not control, endorse, or guarantee the accuracy, efficacy, or safety of their offerings.

It's crucial to provide our readers with clear information regarding the inherent nature of services and products that might be covered in this newsletter, including those advertised by our sponsors from time to time. When you buy cryptoassets (including NFTs) your capital is at risk. Risks associated with cryptoassets include price volatility, loss of capital (the value of your cryptoassets could drop to zero), complexity, lack of regulation and lack of protection. Most service providers operating in the cryptoasset industry do not currently operate in a regulated industry. Therefore, please be aware that when you buy cryptoassets, you are not protected under financial compensation schemes and protections typically afforded to investors when dealing with regulated and authorised entities to operate as financial services firm.