- Sporting Crypto

- Posts

- Sorare's 2025 Strategy

Sorare's 2025 Strategy

After a tough start to the year, Sorare have seen a surge in sales volume since the beginning of August 2025, and have smashed all-time transaction records. What does their future hold?

Join 4750+ Leaders in Web3 & Sports from brands like FIFA, NBA, Premier League, NHL, reading Sporting Crypto every week 👇️

👥🔍 Sporting Crypto Job Board - Jobs of the week

Visit the Sporting Crypto Job Board today to explore new career opportunities or to find the perfect fit for your organisation.

Sorare's 2025 Strategy

Discussed in this edition of Sporting Crypto:

1) Sorare’s 2025 Strategy 📆

a) Overview

b) Data analysis

2) Analysis 🧠

3) Concluding Thoughts 💬

Get your tickets to Sports Blockchain Summit London → 5th November 2025!

Sorare’s 2025 Strategy 📆

Sorare, the NFT fantasy giant, raised $680 million in a Series B funding round in September 2021, which valued the company at $4.3 billion.

In the heady days of the frothy NFT bubble of 2021, this was huge, but still paled in comparison to NBA Top Shot creators Dapper Labs, who raised $725m at a $7.6bn valuation, and NFT marketplace OpenSea who raised a $300m Series C at $13.3bn valuation, for example.

And yet, the Paris-based unicorn have recalibrated the game to change the trajectory of the business.

When the game was first introduced, players were able to select 5 NFT cards per lineup, and hit a ‘threshold’ to win Ether, Ethereum’s native currency. This was a hard cost to the business, which was eventually removed in September 2024.

Since then, although not necessarily correlative, Sorare’s monthly sales dropped to their lowest since the beginning of 2021, falling to as low as $2.7m in June 2025.

When you consider the average monthly sales in:

2022 = $28.6m

2023 = $14.5m

2024 = $8.3m

The steep decline could be seen as worrying.

Source: Cryptoslam

As the chart shows, however, there has been a recent spark for Sorare, with over $20m in sales volume in August 2025, and closing in on $10m sales volume in Septemebr 2025.

This has stemmed from a change in the game dynamics, adding a quasi-threshold mechanic back to the game, in the form of hot streaks.

The payouts happen on a cumulative basis, encouraging players to hit higher and higher scores, in a row.

The hard costs and margins for Sorare adding this type of element back into the game are unknown, but the revenues seen from the sales increase are no doubt positive for the business.

And this was definitely needed, if you go by the reporting of French outlet L’informe, who (via SBC news) who said that the businesses’ cash reserves went from $230m in 2023 to $91m in 2024, and expected to be down to $41m by the end of 2025.

According to the same report, the revenues in 2022 were $167m (against sales volumes of $343m) and $69m in 2023 (against volumes of $173m) with EBITDA losses of $234m.

In 2024, revenues dropped again to $50m, but EBITDA losses were halved to $117m.

The reduction in losses could be because Sorare has succeeded in driving a five-fold decrease in its licensing costs, and some leagues have become shareholders. Additionally, they have reduced their headcount in New York City, concentrating their operations in Paris.

If we extrapolate to 2025, assuming low 8-digit sales volumes for the rest of 2025, the numbers look similar in terms of sales volumes and revenues. EBITDA losses are, of course, very hard to predict without understanding the full scale of the company’s operating costs, but using the trend of reduction in losses, this is where it has ended up.

2024 and 2025 look like consolidatory years for Sorare, and the reduction in EBITDA losses are kind, considering they are no doubt ‘paying more out’ to increase traction in this early football season in August 2025.

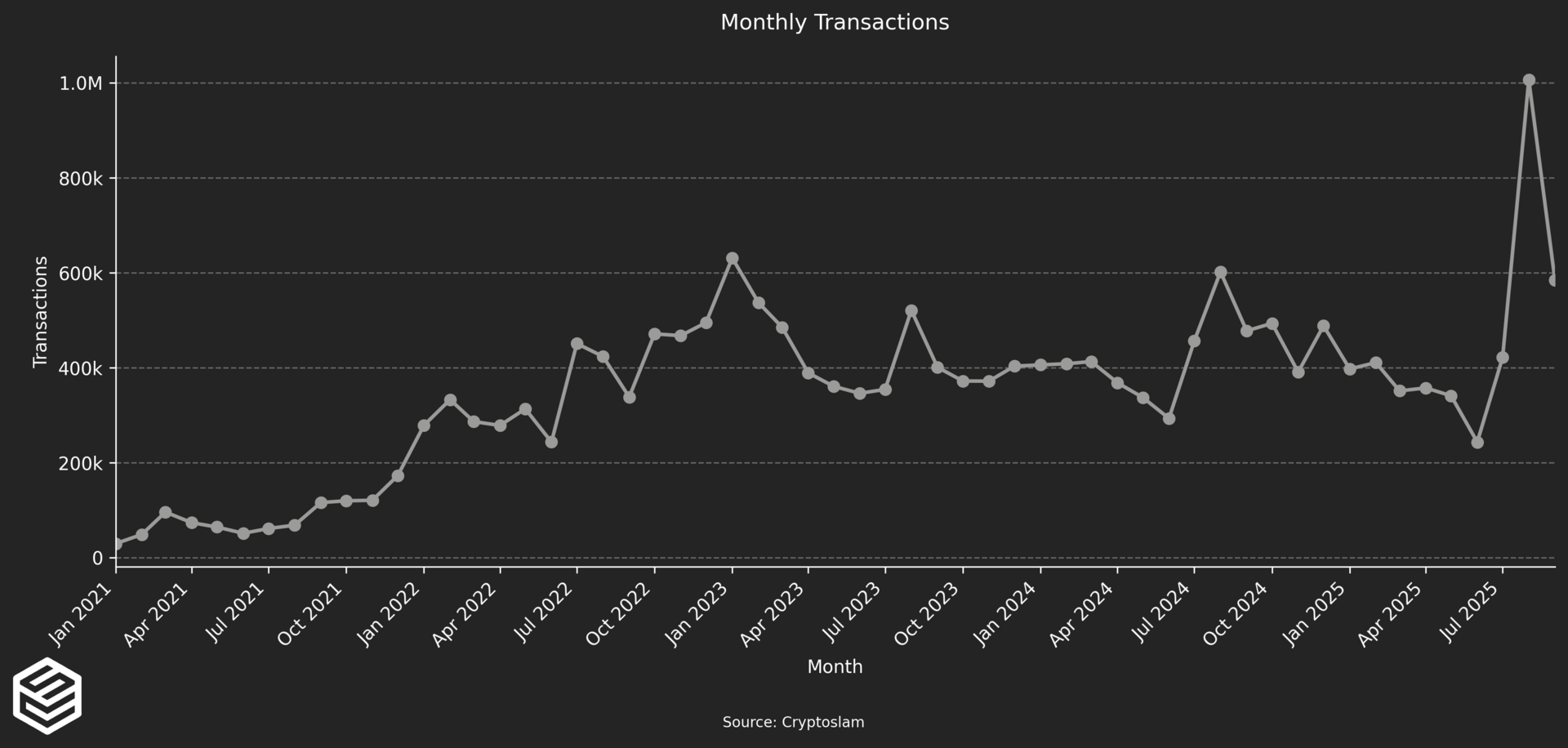

Sorare’s Transactions and Unique Buyer numbers, however, do show strength.

Source: Cryptoslam

Their transaction numbers have seen their highest ever, peaking at over 1 million monthly for August 2025.

Source: Cryptoslam

Their monthly unique buyer numbers have also stayed pretty solid since 2022. There was a drop off through 2025, but that has seemingly been rescued by the recent change in game mechanics.

Analysis 🧠

Sorare have become the default for rightsholders to shop a category of rights that did not exist 5 years ago.

But with waning sales and revenue numbers, their next stage in business is critical.

Other avenues for revenue are also being looked at.

For example, Sorare is reportedly going to earn up to $10 million for a migration from Ethereum Layer 2 Starkware to blockchain Solana, according to Big Whale.

They also mention the idea of a token, which would be an interesting move for Sorare, and signficantly change their business model. It would not be the first NFT marketplace style business to do this, with the likes of Magic Eden already having launched a token — and market leader OpenSea looking to do the same soon, according to reports.

The trouble is, these tokens tend to struggle.

This chart shows Magic Eden’s drop from a $700m market cap token to trending to just over $100m.

Another option is to raise capital, but considering their previous monster round, it would almost certainly be at a much lower valuation than the $4.3 billion, which could cause difficulties with investors. They would also need to show growing signs of revenue, so perhaps creating season-on-season paratemers rather than year on year, could give them a larger multiple valuation in that case.

They could also try to trend to profitability, which would require an increase in the margin— a lower minimum guarantee to rightsholders and increased sales.

A final route is M&A, and with their valuation, this would have to be at a hefty discount, and the ideal partner for that is not clear. Perhaps someone in the prediction markets space, or a behemoth in the collectibles space, but that pathway seems like a last resort, if necessary.

Concluding Thoughts 💭

(1) Sorare’s identity is tied to sports rights

Sorare’s biggest cost is the money they pay to rightsholders, and they ideally want that to be as low as possible. However, those rights are what they have built their business on — and not having them is critical. So there is leverage for rightsholders to ensure they are made whole.

(2) But there is nobody else to buy them

On the other hand, Sorare will look at it in this manner: who else is there to buy the rights?

When Sorare landed a landmark $30m per year deal with the English Premier League, there were competing bids from both Consensys and Dapper Labs. If they were to come up for grabs again, who is the competing bidder? Sorare’s leverage is their monopolisation of a very narrow subset of rights, and if I were betting higher or lower on these rights prices, I would bet on lower.

(3) The 2021 giants need new life

The likes of Sorare, Dapper Labs and such arguably need a new breath of life. Sorare’s recent increase in revenues is positive, but the business model remains the same and the margins look similar. Something has to change for it to be the same game and business in the long term. Those changes look like they are happening, but the results will dictate the future of the business.

(4) - Not being the ‘in’ thing is hard

When momentum is with you, raising at lofty valuations from the world’s best funds can make a business feel unstoppable. One could argue that the likes of Polymarket and Kalshi are in that position now, raising billions in valuation, because prediction markets are the hottest thing on the market. Sorare are not, so their business proposition and books have to be solid for growth, or a future raise.

More Sports & Web3 Stories

Prediction market Kalshi overtakes Polymarket and sets off sports betting ‘land grab’ (Read more here)

LBank Partners with Argentine National Team as Regional Sponsor (Read more here)

FaZe Clan secures expanded $3.25m Rollbit deal (Read more here)

Sports Illustrated Tickets and Tottenham Hotspur announce 12-year Official Fan Experience partnership (Read more here)

Tristan Thompson Taps Somnia to Bring Basketball Fandom On-Chain (Read more here)

FIFA Rivals hit 1 million matches and 1 million downloads (Read more here)

Ex-Scopely and EA exec Jaim Friesen joins Auto Legends as studio GM (Read more here)

Courtyard launch soccer packs (Read more here)

General ‘Stuff’ that Could Impact You

Thanks for reading the latest edition of the Sporting Crypto newsletter!

If you enjoyed this, please tell your friends who might be interested, and share it on socials.

Disclaimers

This newsletter is for informational purposes only and is not financial, business or legal advice. These are the author’s thoughts & opinions and do not represent the opinions of any other person, business, entity or sponsor. Any companies or projects mentioned are for illustrative purposes unless specified.

The contents of this newsletter should not be used in any public or private domain without the express permission of the author.

The contents of this newsletter should not be used for any commercial activity, for example - research report, consultancy activity, or paywalled article without the express permission of the author.

Please note, the services and products advertised by our sponsors (by use of terminology such as but not limited to; supported by, sponsored by or brought to you by) in this newsletter carry inherent risks and should not be regarded as completely safe or risk-free. Third-party entities provide these services and products, and we do not control, endorse, or guarantee the accuracy, efficacy, or safety of their offerings.

It's crucial to provide our readers with clear information regarding the inherent nature of services and products that might be covered in this newsletter, including those advertised by our sponsors from time to time. When you buy cryptoassets (including NFTs) your capital is at risk. Risks associated with cryptoassets include price volatility, loss of capital (the value of your cryptoassets could drop to zero), complexity, lack of regulation and lack of protection. Most service providers operating in the cryptoasset industry do not currently operate in a regulated industry. Therefore, please be aware that when you buy cryptoassets, you are not protected under financial compensation schemes and protections typically afforded to investors when dealing with regulated and authorised entities to operate as financial services firm.