- Sporting Crypto

- Posts

- The State of Prediction Markets 2025

The State of Prediction Markets 2025

Prediction markets have taken over mindshare in crypto. And Sports have taken over prediction markets. What is the state of play?

Join 4500+ Leaders in Web3 & Sports from brands like FIFA, NBA, Premier League, NHL, reading Sporting Crypto every week. You can get in touch by hitting reply to the email 📝

👥🔍 Sporting Crypto Job Board - Jobs of the week

Head of Product Design @ Courtyard.io - Link here

Head of Finance & Operations @ SWEAT Foundation - Link here

Lead Producer, Sports (LiveOps) @ Dapper Labs - Link here

Visit the Sporting Crypto Job Board today to explore new career opportunities or to find the perfect fit for your organisation.

The State of Prediction Markets 2025

Discussed in this edition of Sporting Crypto:

1) Introduction

2) The Players ♟️

3) The Data 📊

4) The Sports Takeover ⚽️

5) The Regulatory Battle 🧑⚖️

6) The Future 🔮

7) How Big is the Sports Implication? ⚾️

Introduction

Prediction markets have been crypto’s best example of product market fit over the last 18 months. Of course, there were experimental, early products like Augur in 2018 (Ethereum’s first ever ICO) — but Polymarket, Kalshi, Crypto[dot]com, Robinhood, Myriad Markets and more have truly taken the concept of prediction markets to the mainstream.

Sports is intrinsically linked to this category.

Whenever anything is linked to speculating on the future outcome of an event, it’s natural that sports has some overlap. This is, after all, humankind’s first, and with AI perhaps last, unscripted drama.

What is a prediction market?

Let’s start by defining prediction markets.

Many will have heard the concept ‘wisdom of the crowds’. The book, by James Surowiecki, is titled: The Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations. It explores how and why the aggregation of information in groups results in decisions that, he argues, are often better than could have been made by any single member of the group.

Essentially, the concept is that a large group of untrained ‘average’ humans has a better shot at predicting the outcome (or height/weight) of something than a ‘genius’ or ‘expert’.

Taking this excerpt from Luca Prosperi’s Dirt Roads newsletter, where he takes Surowiecki’s first anecdote/case study, about a group of people predicting the weight of an ox:

“Galton’s 1907 ox-weight experiment is one of the most notable examples. At a country fair, 800 people were asked to estimate the weight of an ox after slaughter; the average of their guesses came to 1,197 pounds, remarkably close to the actual weight of 1,198. The dream of turning crap into gold has been with us for a long time, under many names. Still, it’s true that educated judgment aggregation works well in many contexts, with or without a financial angle.”

He goes on to define prediction markets:

“In prediction markets, a contract is created that pays a fixed amount if the event occurs, allowing people to trade the contract by submitting buy and sell prices, similar to stock markets. In theory, the price at which the contract trades at any given time should reflect the market’s collective probability estimate of the event happening. Assuming a contract that pays $0 if the event does not occur and $100 if it does, and assuming risk neutrality, a spot price of $60 suggests the crowd estimates a 60% probability of the event occurring.”

To explain more simply, let’s look at Polymarket, who use 100 cents as their 0-100% probability.

For example, for this year’s English Premier League Winner, they give Manchester United a 2% chance, meaning you can ‘buy yes’ for 2¢.

As per a recent Sporting Crypto Podcast with LiveDuel CEO Will Martin, he explains:

"The price you pay is from zero to one. If it's worth $1, that means 100% it's already happened. 53 cents means it's got a 53% chance of happening. So it's a really interesting way of presenting probabilities... whereas that percentage chance of it happening is very easy for people to lock into and understand what's going on."

Polymarket is the biggest prediction market in this space, built on blockchain.

Polymarket uses smart contracts to automatically settle markets, and something called UMA’s optimistic oracles to ensure that offchain data is ratified quickly and efficiently by the onchain marketplace.

If that sounds like technical jargon, it’s because it is. An Oracle is essentially a bridge or system that ingests off-chain data (sports outcomes, elections) and delivers that data to a smart contract (on a blockchain) that executes an event (pays out winning predictors). This means there is less load on the blockchain from a data perspective.

After stablecoins, prediction markets have become blockchain’s next big product market fit moment, spanning beyond the hands of just 10s of thousands of crypto enthusiasts. Prediction markets have broken into the mainstream, and there’s no turning back.

The Players ♟️

There are two main players in the World of Prediction Markets.

Polymarket

Kalshi

They are by far the biggest in terms of volume.

Before examining the data behind the two largest players, it’s worthwhile to take a closer look at who these companies are.

Polymarket are an onchain prediction market where users use stablecoins to wager on the outcome of events. It uses smart contracts to execute payouts, and offchain oracles to ratify information to those smart contracts.

They were the ‘offshore’ player when it comes to the United States… until recently, where they have made an acquisition of CFTC-Licensed Exchange and Clearinghouse QCEX for $112 Million… and recently announced no other than Donald Trump Jr. as an advisor after his investment vehicle 1789 Capital made a strategic investment into the company.

Here’s a Polymarket timeline over the last 12 months:

Aug – Oct 2024:

The FBI raided founder Shayne Coplan’s home as part of a DOJ probe into U.S. access.

Countries including Switzerland, France, Poland, Singapore, and Belgium blocked or restricted the platform due to gambling regulation violations.

Despite pressure, activity around the 2024 U.S. election cycle surged, with billions in trading volume.

Nov 2024 – Jan 2025:

It accurately priced in Joe Biden’s withdrawal and Kamala Harris’s VP pick earlier than mainstream forecasts.

Nate Silver joined as an advisor.

Feb – June 2025:

Polymarket closed $70M in funding rounds with backing from Vitalik Buterin and Founders Fund.

DOJ and CFTC investigations formally closed, easing regulatory uncertainty.

In July, Polymarket acquired QCEX, a licensed U.S. derivatives exchange and clearinghouse, for $112M—its clearest path yet to U.S. market re-entry.

July & August 2025: User Growth & Valuation

Polymarket neared a $1B valuation following a new investment round.

Donald Trump Jr., via 1789 Capital, invested tens of millions and joined the advisory board.

A trader won $50,000 betting on Taylor Swift and Travis Kelce’s engagement, sparking media coverage and insider-knowledge speculation.

A $210M market dispute over whether Zelenskyy wore a suit sparked a frenzy amongst traders.

Kalshi are the next biggest player in this market. They have taken a more ‘regulated’ and compliant approach as it pertains to the United States, getting a CFTC license early on. That has not, however, been without its challenges. They have faced several cease and desists and gone to court with regulators. They have been successful with most of these legal challenges.

Here’s a Kalshi timeline over the last 12 months:

Aug – Oct 2024

After a lengthy legal battle, Kalshi won clearance to relaunch fully regulated U.S. election markets.

Contracts quickly covered congressional control, the presidential race, swing states, and more.

Within the first week, millions of dollars traded on these election contracts.

Nov 2024 – Jan 2025: Political Connections

In January, Donald Trump Jr. joined as a strategic adviser.

Mar 2025: Robinhood Partnership

Robinhood launched a prediction markets hub powered by Kalshi, making its contracts accessible to a mass retail audience.

The hub included sports and policy outcome markets.

Jun and July 2025

Kalshi raised $185 million in a Series C round led by Paradigm, with support from major investors. This valued the company at $2 billion, making it one of the highest-valued prediction market operators.

Kalshi launched new markets letting users trade on whether companies like Stripe, OpenAI, Databricks, Brex, and xAI would go public by year-end.

Aug 2025: Sports Expansion

Expanded into sports prop bets (e.g., player touchdowns, spreads, over/unders), positioning itself more like a sportsbook alternative.

Faced a legal setback in Maryland, where a court ruled it wasn’t immune from state gambling laws.

The NFL raised integrity concerns, arguing that prediction markets lacked the responsible gaming safeguards of regulated sportsbooks.

Meanwhile, cultural markets like Taylor Swift’s engagement brought mainstream attention, though volumes were smaller compared to elections.

Announced a partnership with xAI’s Grok chatbot, feeding its market data into AI-powered insights.

On top of this, we have seen the likes of CME Group and FanDuel partnering to develop a prediction market offering, which now means that the players from finance, crypto and gambling have fully geared up to attack this space.

The Data 📊

The data behind these markets is eye-opening.

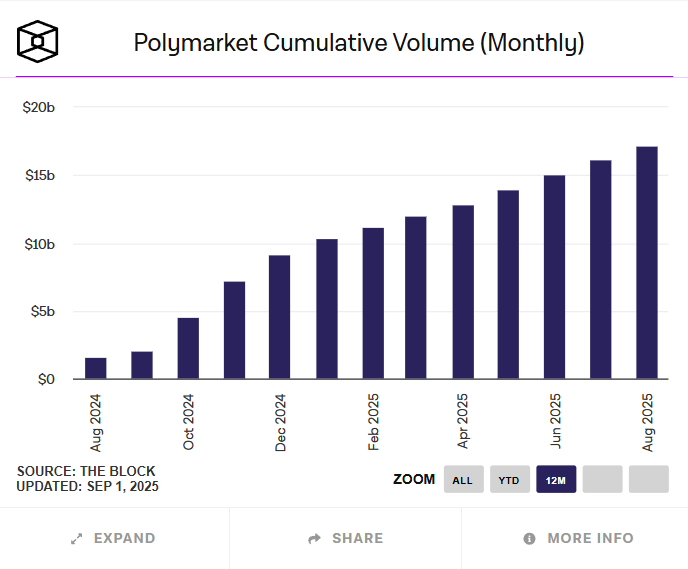

In the last 12 months, Polymarket have added ~$15bn in cumulative monthly volume.

Source: The Block

And in terms of active traders, they have actually decreased year-to-date, from ~450,000 monthly traders to ~225,000 monthly traders.

Source: The Block

That being said, year-on-year, the numbers have increased massively, from ~40,000 monthly active traders to the ~225,000 mentioned above.

Source: The Block

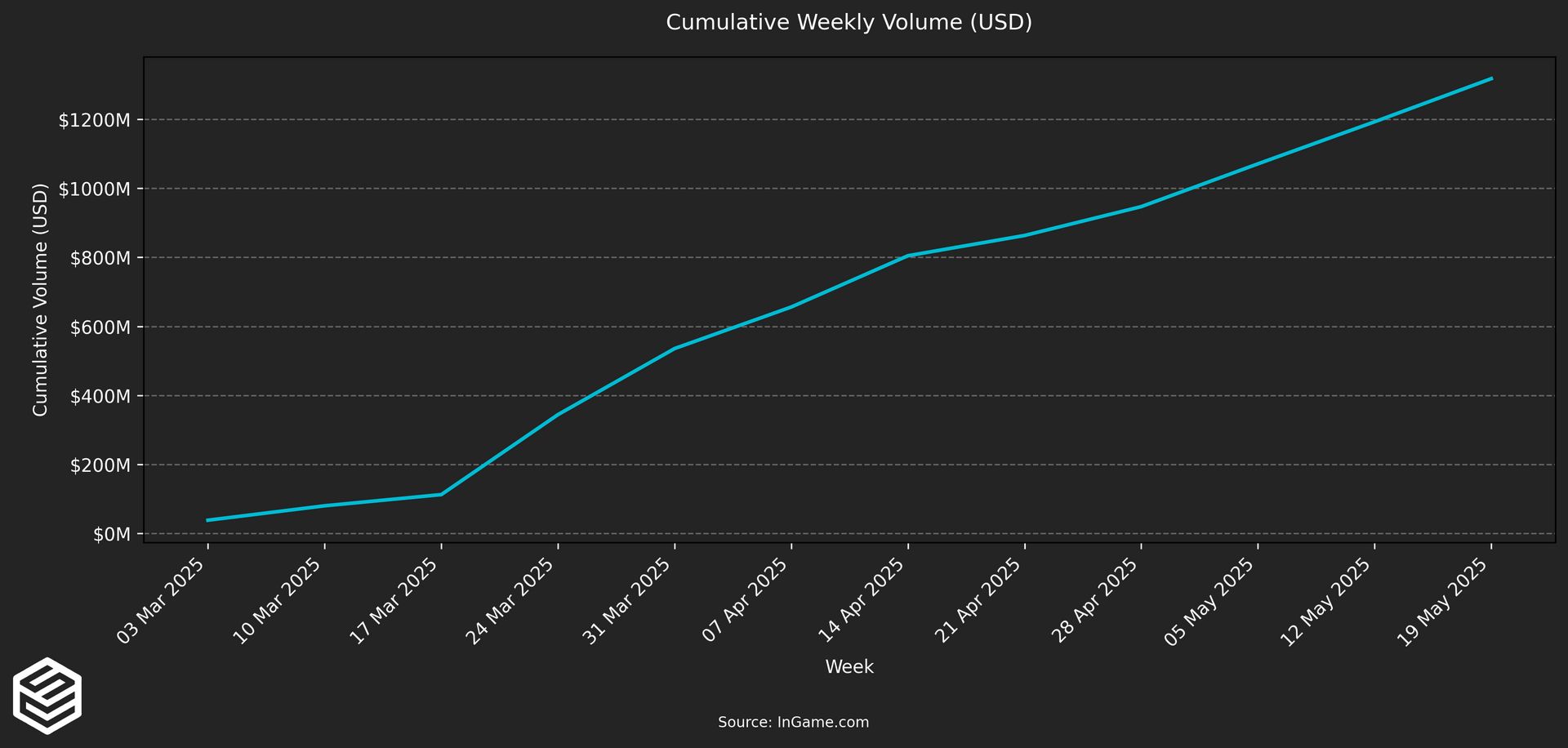

In the last 6 months, Kalshi has also seen explosive growth.

Below is a chart showing cumulative volume from 3rd March 2025 to late May 2025, which shows $1.3bn in volumes.

S

Extrapolated through to the end of the year, Kalshi could breach $5bn in volume between now and the end of 2025, with an annualised run rate of $6.49bn.

This would be a significant uptick from 2024, which saw $2.4bn in trading volume, as per the company’s Instagram post below:

Source: Kalshi Instagram

Based on data gathered, Kalshi is currently running at a 20-30% volume ratio to Polymarket.

The chart from Dune below shows that the delta could be larger (data ends in July 2025).

(You can spot in march 2025 where Kalshi entered the sports market, during March Madness)

On the other hand, taking data from the great Fintech Blueprint Newsletter, which looked at year-on-year average monthly trading volumes, Kalshi is closing the gap.

The Sports Takeover ⚽️

Let’s get to it, then.

The reason this is being published in Sporting Crypto.

People are not digesting the huge shift in consumer behaviour we are seeing in real time.

Many questioned whether Polymarket for example, had the staying power post 2024 elections.

In November 2024, a Reddit user conducted an analysis that showcased the distribution of categories on Polymarket. The results are pretty incredible, with over 50% of events being sports-based.

Fast forward to February 2025, sports became Polymarket's largest category by volume, just four months after representing only 17% of the platform's trading activity in November 2024.

The platform's lifetime sports-related contract volume has surpassed $9 billion, with the 2025 Super Bowl alone generating $1.1 billion in wagers, underscoring the big shift over the last 12 months from politics to sport.

That means that of Polymarket’s $17 billion in lifetime cumulative volume, $9 billion is sports-related.

Indeed, this is reflected in the company’s marketing strategy as well.

The X account ‘Polymarket FC’ was created, tapping into influencers and more to broaden reach, and eventually mimic viral, update-based content to appeal to a specific demographic.

Indeed, in Prosperi’s article which was earlier cited, he questions Polymarket’s long-term sustainability in a post-US-election world:

“Despite Polymarket’s upgrades, it struggled to maintain momentum—this until the 2024 US elections. Prediction markets, it turns out, tend to wake up every four years. 2024 saw volumes exploding (Dune) from $6 million to $25 million, then $100 million, and now surpassing $650 million monthly. Over 80% of this activity remains tied to election-related markets, turning Polymarket into a temporary darling for political analysts and even a data reference for Elon Musk.

But the question looms: can it endure the post-election hangover? Polymarket’s competitive edge lies in its (kind of) decentralised nature, skirting around traditional regulatory barriers that shackle mainstream betting platforms, especially for political events. The CFTC’s 2022 action (a $1.4m fine) was a reminder that regulatory arbitrage has limits. And despite geofencing and formal restrictions, a substantial portion of the site’s traffic likely still comes from the US.”

But here is where I think (with the privilege of hindsight), Luca, like many underestimated:

The Genie is out of the bottle. Once the media, analysts and everyone else realise that (due to the wisdom of crowds) this data is more accurate, they are compelled to use it.

Marketing. Polymarket has especially gone hard in sports to make themselves synonymous with huge fan accounts, highlights and more.

Regulatory arbitrage. According to casino.org 26% of the adult world gambles (1.6bn people per year). There are 350 million people (250-270m adults) — most of whom do not have access to online gambling. With CFTC federal regulation, vs. state-by-state gambling laws — prediction markets like Kalshi, and now Polymarket, give those 250m people to consistent access to online wagering.

Sports. People massively underestimated the size of the global wagering market when it comes to sports. Betfair Exchange itself, had $200 billion in volume in 2024, mostly coming from sports.

Polymarket are not the only ones who have gone all in on sports.

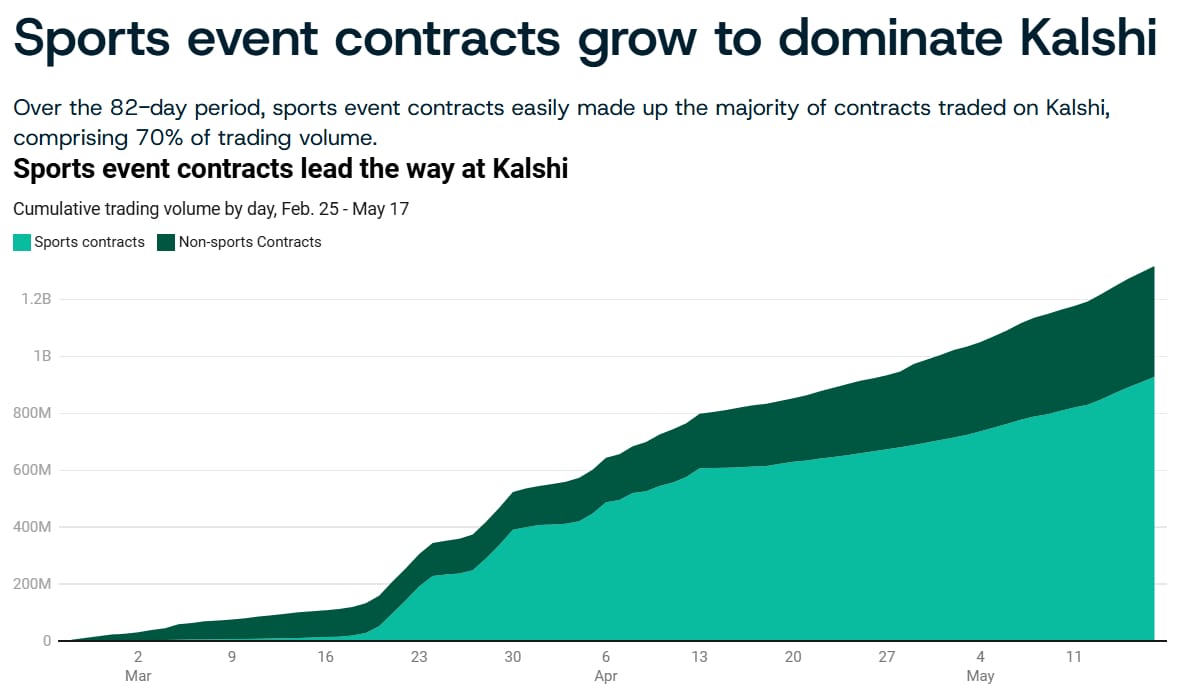

Kalshi have seen explosive growth in the sports category as well.

In fact, Ingame recently reported that Kalshi is now more reliant on sports wagers than Fanduel and Drafkings.

Source: InGame

When Kalshi introduced single-game March Madness contracts, volumes exploded.

Source: InGame

Forget about politics. Sports is the captain now.

The Regulatory Battle 🧑⚖️

The explosion in volume for both Polymarket and Kalshi has not come without issues.

As per this fantastic infographic by Ingame, many states in the United States have gone head-to-head with Kalshi, specifically. (Note that up until now, Polymarket have been banned from the United States.)

Green: No state agency has sent cease-and-desist letters to trading platforms.

Yellow: State agencies are investigating trading platforms.

Blue: State agencies have sent cease-and-desist letters to trading platforms.

Red: Trading platforms have made legal filings in response to cease-and-desist letters.

Source: Ingame.com

This will continue. States will not let tax money escape their grasps with ease, and will fight till the bitter end for it.

The issue here is that Kalshi, and now Polymarket, are state regulated by the CFTC. As are Crypto[dot]com. This weakens any states looking to fight these businesses in court, massively.

It’s regulatory arbitrage. And it feels like prediction markets are too big now, at least in terms of volume, to bucket and define into a new regulatory category.

That’s especially the case now as the likes of CME & FanDuel step in. This mammoth market is about to get fatter, and I don’t think state-by-state gambling laws are going to be able to do much about it.

The Future 🔮

Now that we are getting a maturing landscape with ‘everything’ prediction markets (Kalshi, Polymarket and now FanDuel & CME, Crypto) — it’s natural we see a verticalisation of this space.

Those competing with these behemoths will struggle. They have scale, usage and partnerships (Kalshi are partnered with Robinhood) and will be very difficult to beat.

So where do entrepreneurs go, and where is the opportunity?

We’re already seeing a verticalised or niche approach, which I think will cause a proliferation of new products, before we eventually see some form of consolidation.

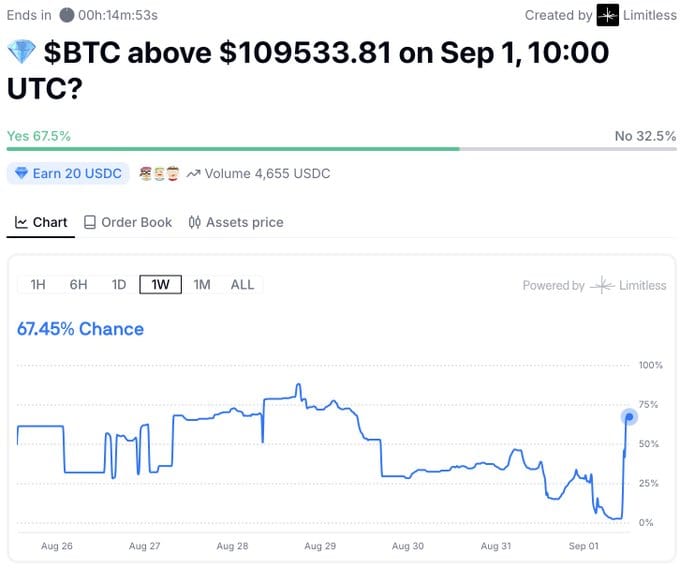

Limitless, for example, is a new prediction market that has found a home in ultra-tight windows of time, making their niche with day-traders. An example of this is unders/overs on Bitcoin price at a specific time, in this case, 10 am on Sept 1st.

They have recently seen an explosion in users, with thousands of weekly active addresses.

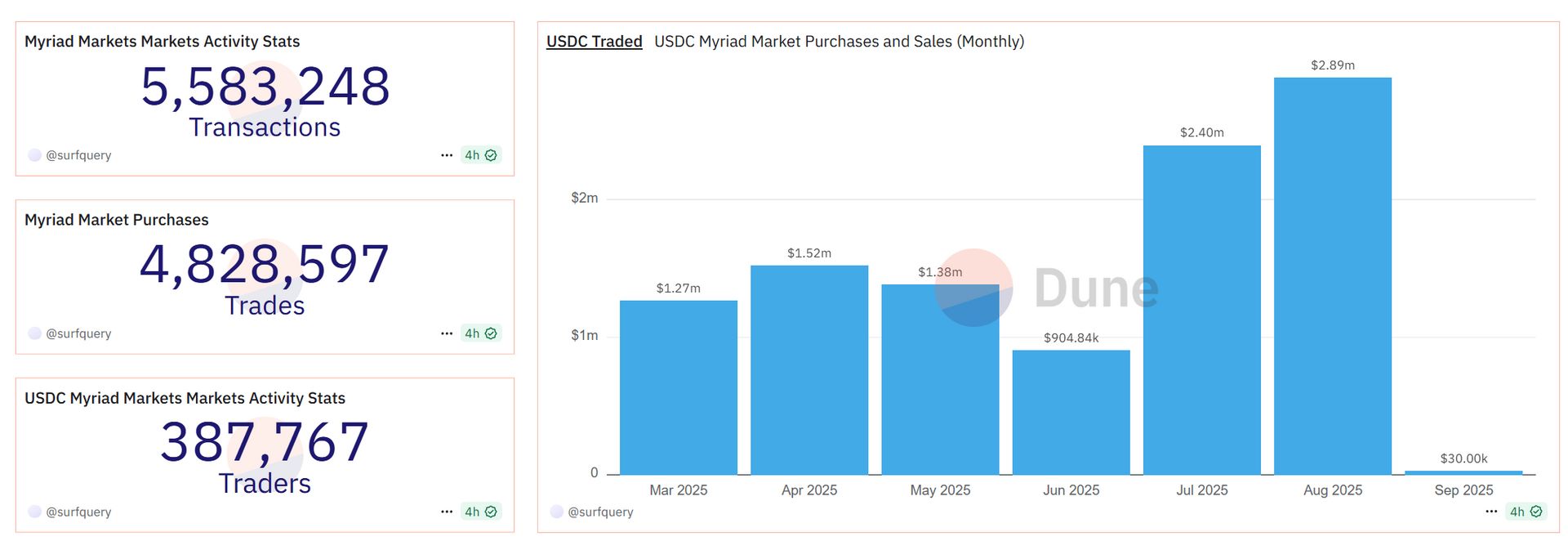

Myriad Markets, launched by the holding company that now own both Rug Radio (crypto influencer and media business) and Decrypt (crypto publication) launched Myriad markets earlier this year.

Their edge is to embed markets into their media, and have so far seen over 5.5m transactions and over 4.8m trades.

August 2025 was their best month in volume terms, with $2.89m in volume.

Source: Dune Analytics

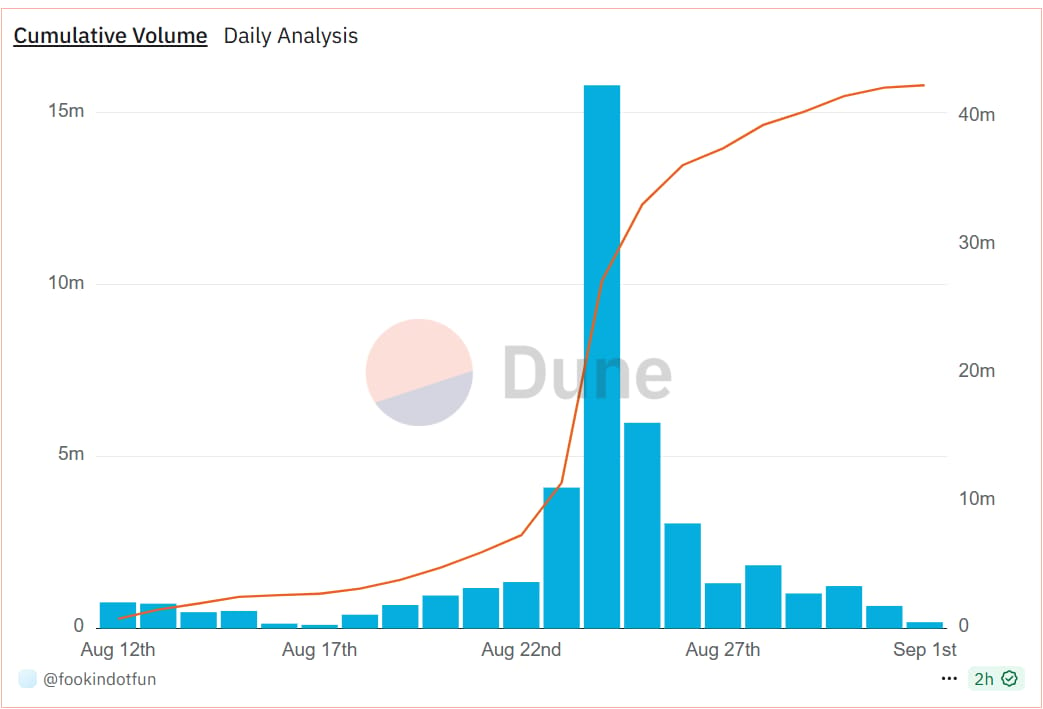

Getting more niche with derivatives, Football[dot]fun is a new platform which allows users to speculate on the performance of individual football players — has also seen explosive growth — with over $40m in cumulative volume… in the last month.

Source: Dune Analytics

Want something even weirder?

Fantasy[dot]top is a fantasy game that lets you purchase NFT cards of crypto influencers…and build teams where you predict the mindshare they gain on X and other social platforms in a given ‘gameweek’.

Speaking of mindshare — noise[dot]xyz lets users trade on whether a trend will gain or lose mindshare.

We are entering the derivative era of prediction markets, because the fatty horizontal layer of ‘predicting anything’ or sports outcomes, is fast reaching market maturity.

How big is the sports implication? ⚾️

So we understand that the speculative nature of these markets is tethered to sports, and will continue to be so for as long as regulation allows users to participate.

But could it actually change the consumption of sports itself?

I’ve believed that it wouldn’t, for a while now.

But I think that may be changing.

Here’s a really random example.

I am UK-based and thus keeping tabs on U.S sports is much more difficult.

As a fan of the NBA, I use YouTube highlight packages to consume the sport. Sometimes, in the morning over breakfast, when I don’t know the score of games.

During last year’s NBA playoffs, I noticed that Polymarket's odds on screen showing me the live percentage odds of one team winning over the other. And it was pretty fascinating in how it changed my consumption of the highlights, play by play. It’s quantifying the unscripted drama of sports, and therefore amplifying that feeling you get when you see a huge upset. The elation you feel when you see a massive comeback. It’s hard to put into words, but seeing that a team had a 2% chance of winning and doing so, makes that feeling more pointed.

There’s also the added change in sports consumption that we’re seeing in real time.

YouTubers are getting top-tier European sport broadcast rights.

The relationship between fan and team is now being morphed and stitched together by influencers as much as it is being tied to elite-level athletes.

It’s weird, and there’s a shift.

And the connection might not be obvious right now, but we are seeing the way fans connect and consume sport change.

The aspect of having something riding on the outcome, or a derivative of the outcome, is only going to proliferate and therefore morph this into something even weirder than what we experience currently as fans.

Thanks for reading the latest edition of the Sporting Crypto newsletter!

If you enjoyed this, please tell your friends who might be interested and share it on socials.

Disclaimers

This newsletter is for informational purposes only and is not financial, business or legal advice. These are the author’s thoughts & opinions and do not represent the opinions of any other person, business, entity or sponsor. Any companies or projects mentioned are for illustrative purposes unless specified.

The contents of this newsletter should not be used in any public or private domain without the express permission of the author.

The contents of this newsletter should not be used for any commercial activity, for example - research report, consultancy activity, or paywalled article without the express permission of the author.

Please note, the services and products advertised by our sponsors (by use of terminology such as but not limited to; supported by, sponsored by or brought to you by) in this newsletter carry inherent risks and should not be regarded as completely safe or risk-free. Third-party entities provide these services and products, and we do not control, endorse, or guarantee the accuracy, efficacy, or safety of their offerings.

It's crucial to provide our readers with clear information regarding the inherent nature of services and products that might be covered in this newsletter, including those advertised by our sponsors from time to time. When you buy cryptoassets (including NFTs) your capital is at risk. Risks associated with cryptoassets include price volatility, loss of capital (the value of your cryptoassets could drop to zero), complexity, lack of regulation and lack of protection. Most service providers operating in the cryptoasset industry do not currently operate in a regulated industry. Therefore, please be aware that when you buy cryptoassets, you are not protected under financial compensation schemes and protections typically afforded to investors when dealing with regulated and authorised entities to operate as financial services firm.