- Sporting Crypto

- Posts

- The State of NBA Top Shot 2025

The State of NBA Top Shot 2025

The once chart-topping digital collectible product just launched their 2025/26 season. What does the data look like, and what is different?

Join 4750+ Leaders in Web3 & Sports from brands like FIFA, NBA, Premier League, NHL, reading Sporting Crypto every week 👇️

If you’re in London in early November, you need to be at our second instalment of Sports Blockchain Summit.

𝗗𝗲𝘁𝗮𝗶𝗹𝘀:

📅 5th November 2025

🕐 830am - 2 pm

👥 Room full of decision makers at the intersection of sports & blockchain

Get Tickets HERE

Get your tickets to Sports Blockchain Summit London → 5th November 2025!

The State of NBA Top Shot 2025

Discussed in this edition of Sporting Crypto:

1) NBA Top Shot 2025/26 Season Overview

2) Analysis & The Data🧠

3) Concluding Thoughts 💬

NBA Top Shot 2025/26 Season Overview 🏀

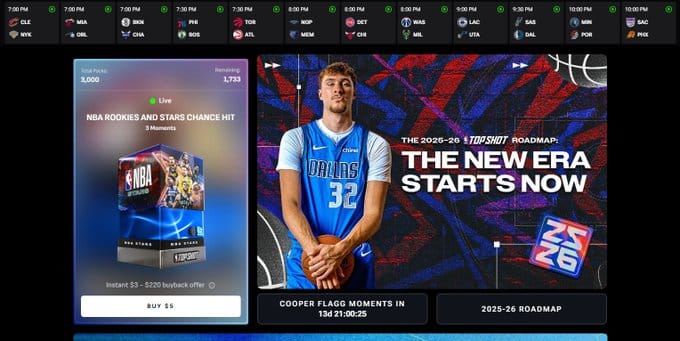

NBA Top Shot, created by Dapper Labs in collaboration with the NBA and NBPA, are back for the latest 2025/26 NBA season.

This year, they’re focusing heavily on rookie cards, mirroring the demand one would see in the traditional collectibles space. It features headline partnerships with top rookies Cooper Flagg, Yang Hansen, and other emerging stars who will debut digital autograph inscriptions and 1-of-1 signature collectibles on NBA Top Shot. Fewer than 5,000 rookie collectibles from Victor Wembanyama or Cooper Flagg will ever exist.

Roham Gharegozlou, CEO of Dapper Labs, said, “NBA Top Shot was built to bring fans closer to the sport they love, ensuring that each digital collectible remains an authentic and lasting piece of basketball culture long term.” This season we’re taking the next step—delivering autographs and interactive collectibles from the NBA’s next generation of stars while securing the highlights themselves on chain.”

Indeed, a big technical change is that this season, the Flow team stated that “the video highlight, the artwork, the metadata, everything – will be stored on a decentralized network starting this season”.

This might not seem like a big deal, but for collectors, there is big value in the permanence of the collectible being fully onchain. As per Flow’s statement it means that the collectible is “independent from any one entity that ownership is guaranteed to be permanent”

This is all part of the biggest Top Shot Roadmap yet (click here to read more) — with changes to gameplay, product, technicals and more as the

One interesting piece of the roadmap is ‘Fandom shock drops’. As per their roadmap:

“For viral, internet-breaking plays, collectors can expect those Moments to go from the court to their collections as fast as possible, capturing the emotional thrill of being a fan while keeping overall supply scarce. The “Top Shot This" set is your Fandom home for the types of plays that have you jumping out of your seat and spamming the group chat.”

Clearly, this is an effort to appeal to younger fans, and lean into the viral nature of online sports discourse.

Analysis & The Data 🧠

NBA Top Shot, like Sorare, have been a victim of their own success to some extent, up until this point. The heady heights of early 2021 and 2022, as shown in hindsight, were completely unsustainable

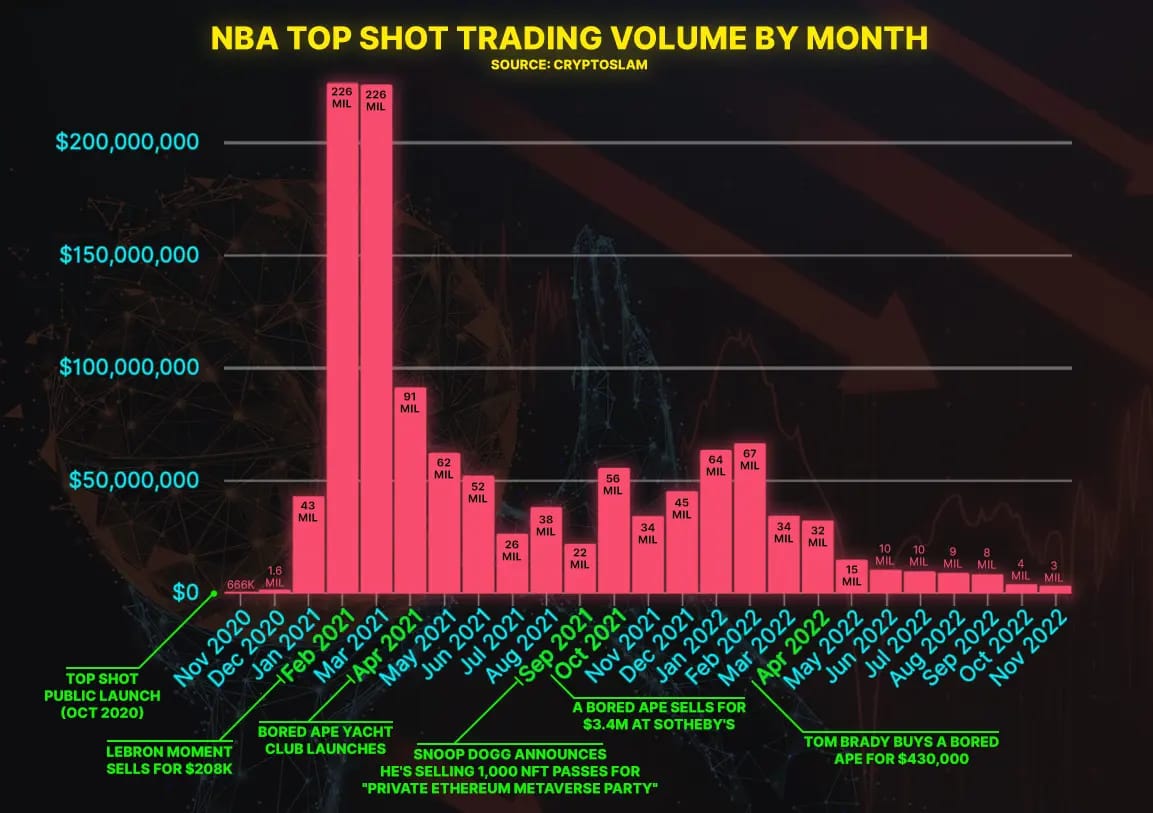

Top Shot had two months of $225m+ volume in February 2021 and March 2021.

Indeed, the end of 2022 saw volumes in 7 digits monthly, which some thought would see a bounceback, but instead became the norm.

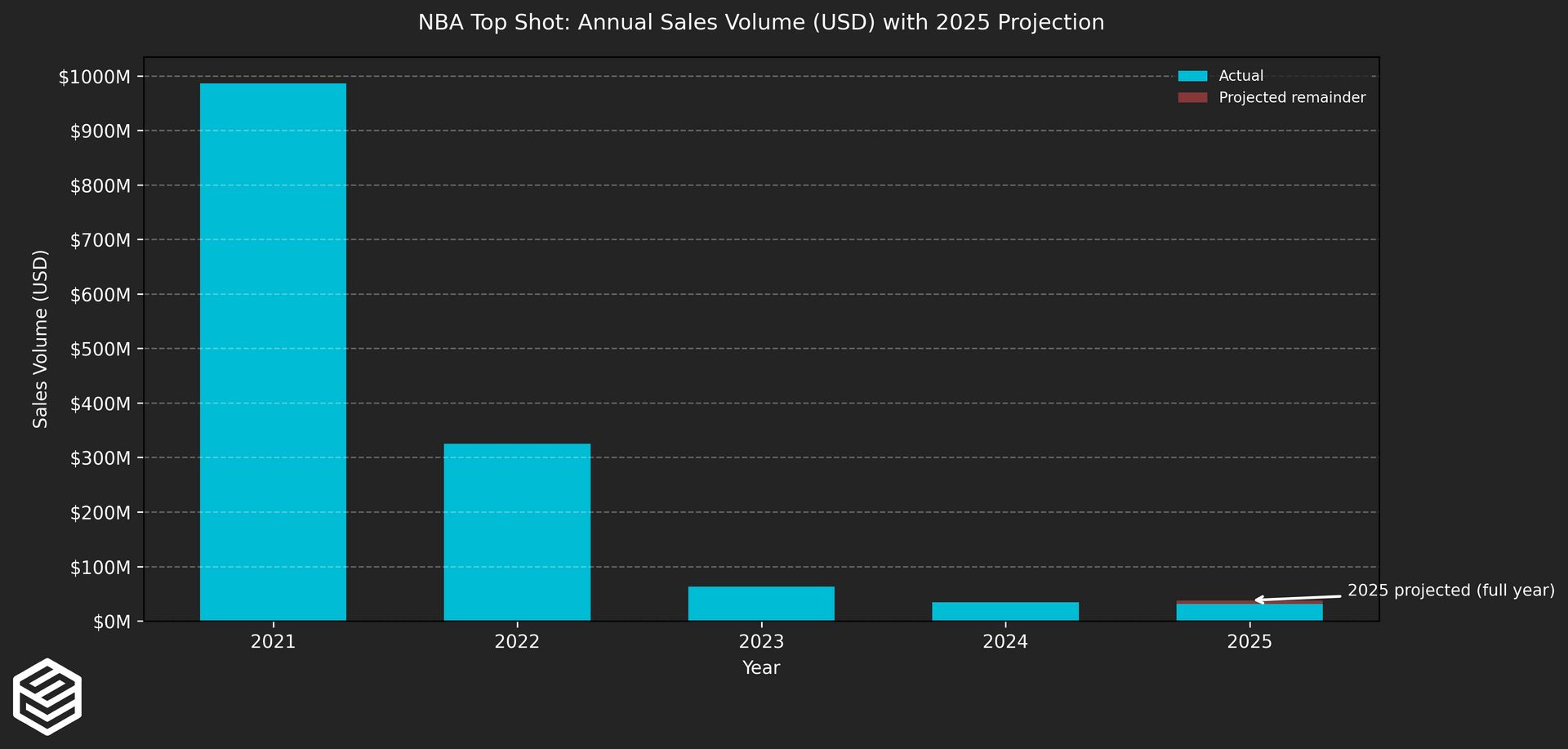

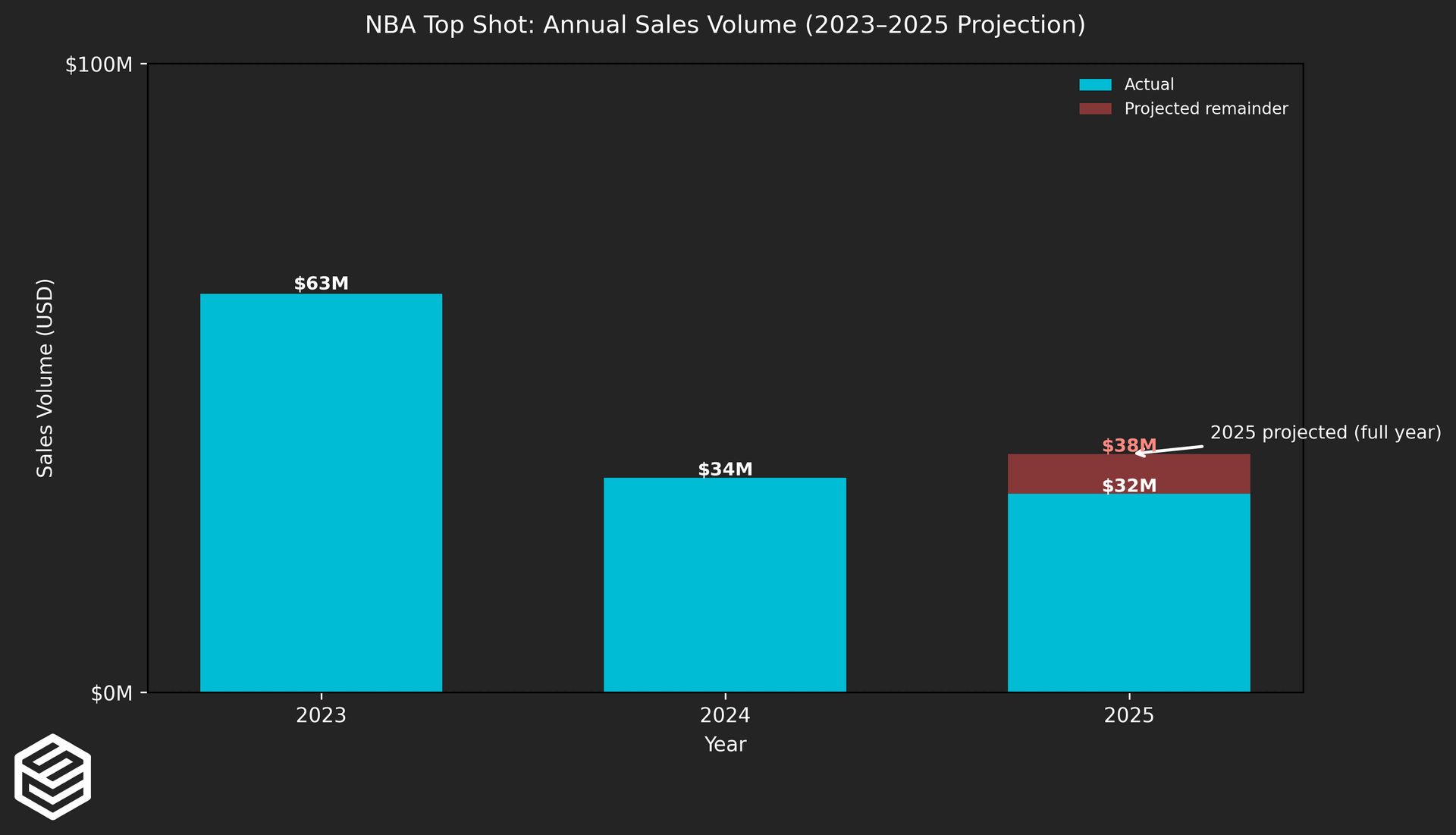

2021 and 2022 now look like the anomalous years, with 2023, 2024 and 2025 looking much more like business as usual. Indeed, some monthly figures from 2021 and 2022 dwarf Top Shot’s yearly run rates in 2023, 2024 and 2025.

Indeed, 2023 - 2025 seem like consolidatory years for Top Shot, with yearly sales volumes that are much more realistic than the lofty previous heights of the NFT bubble.

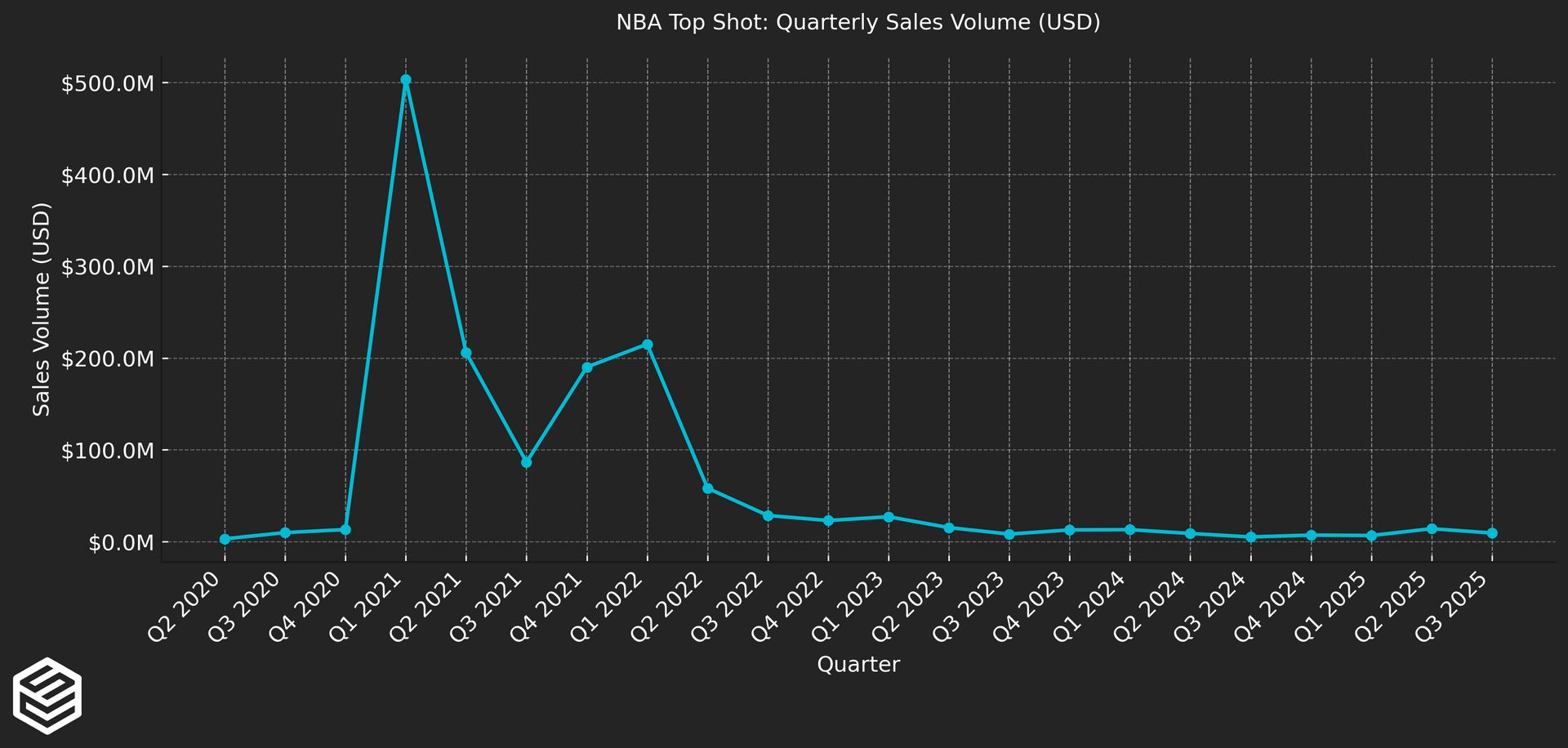

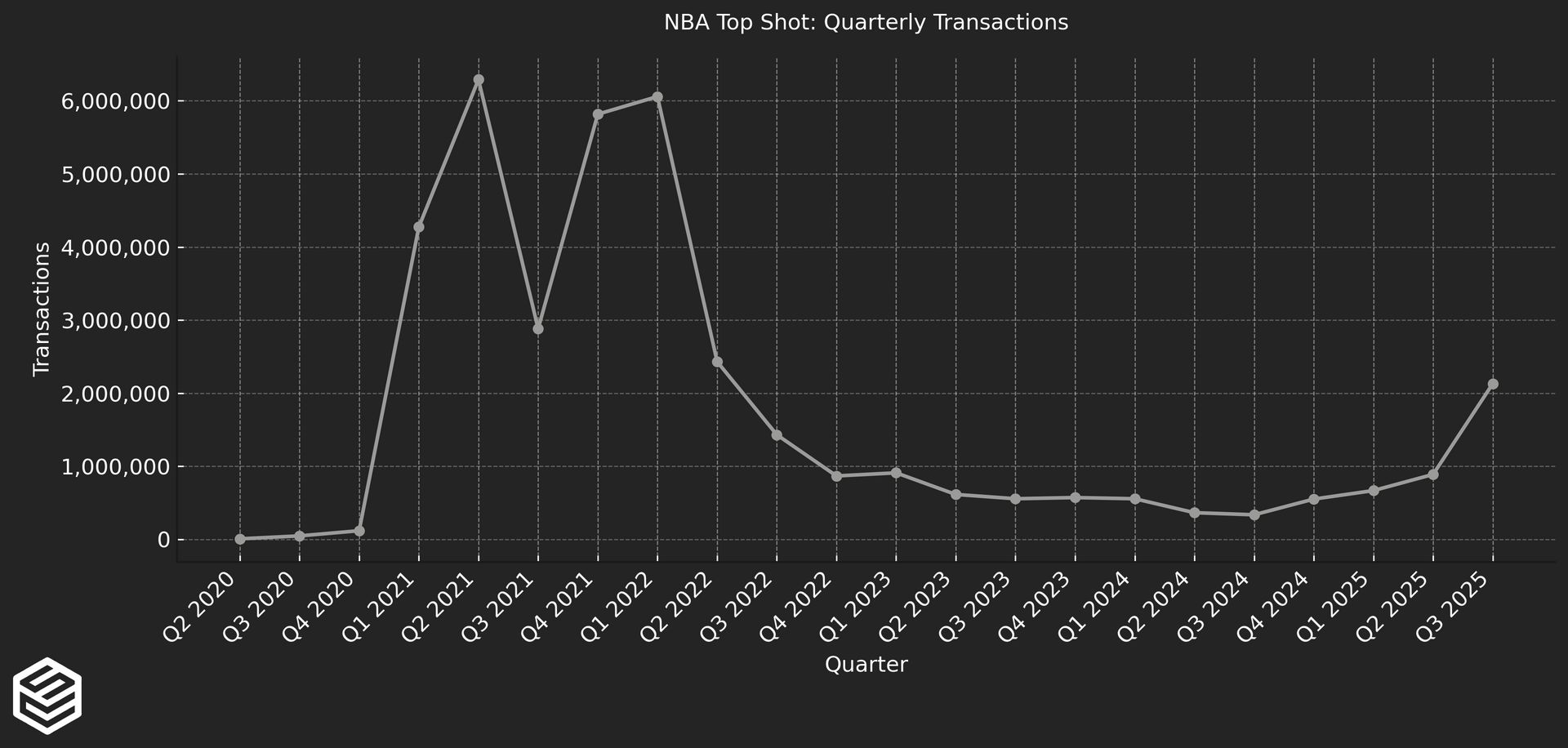

Charting this quarterly shows a similar pattern, with Q4 2022 becoming a sign of things to come rather than a blip in sales volume.

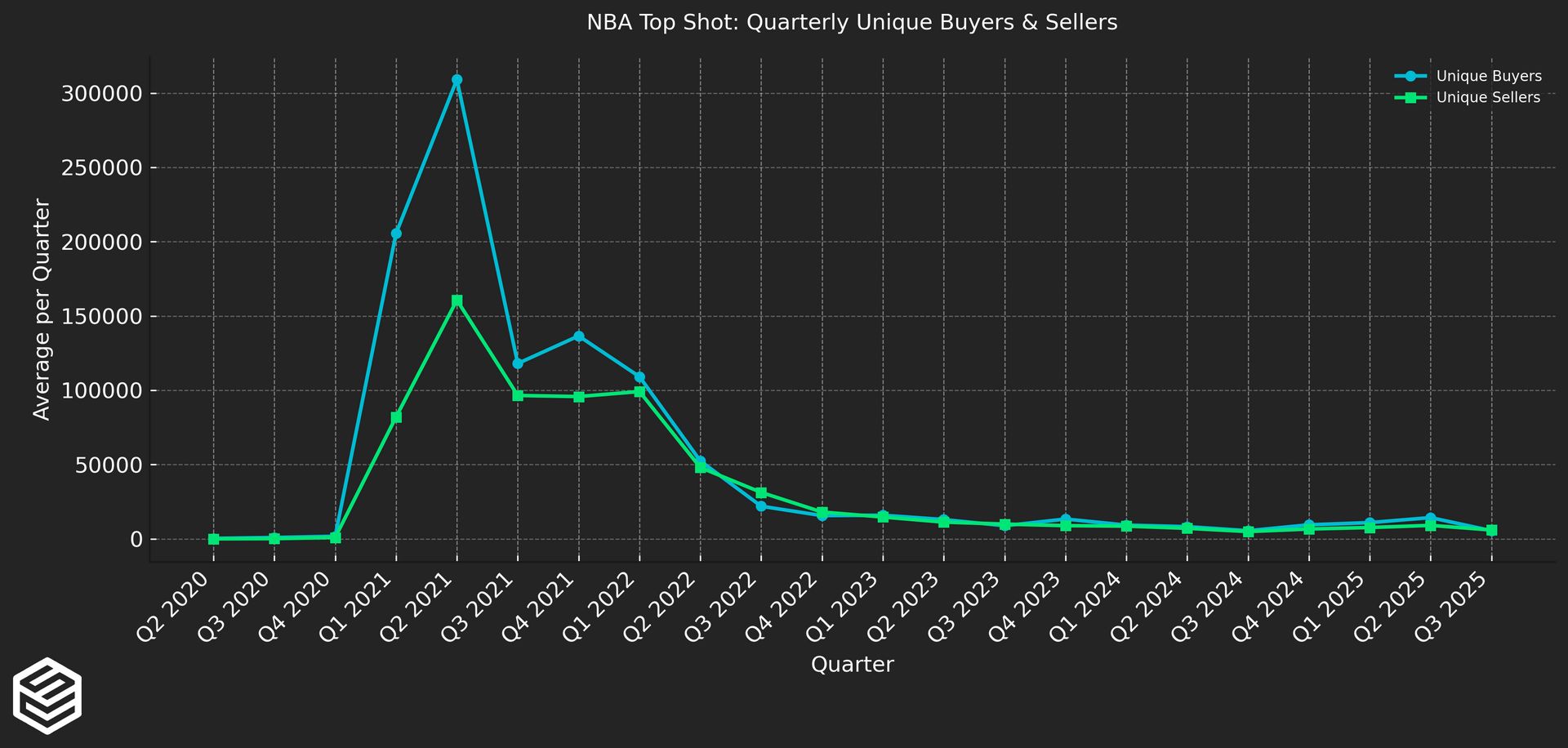

The same can be seen for activity on the platform, with quarterly unique buyers and sellers.

They both peak at the same time as volumes do, and peter towards the mid thousands and stay there.

Transactions, on the other hand, do see an uplift, towards the start of this NBA season, rising in Q3 to levels only seen before toward the end of 2022. Indeed August 2025 was the most monthly transactions that NBA Top Shot have seen in over three years.

Concluding Thoughts 💬

(1) Time to Forget about 2021 and 2022

It’s time to forget about 2021 and 2022, as an industry.

When it comes to digital collectibles, we need to Men in Black style, blank that period from our minds.

It was a once-in-a-generation phenomenon (Covid) coupled with a macro environment that meant middle to upper-class westerners (for the most part) had more expendable income.

Valuations, revenue figures and profit margins need to be recalbirated because this is the new normal.

(2) Focus on product and collectibility is key

I always felt that the core product of NBA Top Shot was the collectibility.

Branching into gamification, fantasy and such always felt to me like a push to remain relevant and compete on other fronts.

But at its core, the product should be playing to the tune of their loyal customers — the collectors.

(3) Licensing is expensive

Licensing NBA players is expensive.

And no doubt, those numbers and deals have been renegotiated by Dapper Labs and the NBA.

But it still does mean that off the rip, the overheads for the business are high.

That is offset somewhat by their huge raises in the past. But there needs to be some path to profitability or sustainability for Dapper Labs to make this worth their while longer term.

(4) But who else is there to buy the rights?

Simultaneously, Dapper have leverage to some extent in making those licensing costs as palatable as possible. Who else, but Dapper, who the NBA invested in, would buy NFT collectible rights from the NBA and NBPA?

It’s an incredibly small market. It’s not like a front-of-jersey sponsor, where there could be dozens of interested parties, driving a market. This is a market of one. So long as it remains that way, there’s an argument to be made that this cost is less ‘hard’ than one would imagine.

(5) Card collecting is in vogue

Card collecting volumes are flying everywhere.

It’s certainly a bubble, but real businesses are being built to serve these demands.

That’s why I think Dapper and Top Shot need to double and triple down on the product, and the collectibile nature of the platform, over everything else.

More Sports & Web3 Stories

MultiBank and Khabib Ally to Launch First Regulated RWA Tokenized Sports (Read more here)

FIFA Rivals Launches 2026 Matchball NFT (Read more here)

Crypto[dot]com to stop offering sports events contracts in Nevada after losing in federal court (Read more here)

NHL Becomes First Major Sports League to License Trademarks to Prediction Markets (Read more here)

DraftKings Prediction Market App Will Focus on States Without Legal Sports Betting (Read more here)

Paris Saint-Germain launches PSG Lab batch #2 (Read more here)

General ‘Stuff’ that Could Impact You

Thanks for reading the latest edition of the Sporting Crypto newsletter!

If you enjoyed this, please tell your friends who might be interested and share it on socials.

Disclaimers

This newsletter is for informational purposes only and is not financial, business or legal advice. These are the author’s thoughts & opinions and do not represent the opinions of any other person, business, entity or sponsor. Any companies or projects mentioned are for illustrative purposes unless specified.

The contents of this newsletter should not be used in any public or private domain without the express permission of the author.

The contents of this newsletter should not be used for any commercial activity, for example - research report, consultancy activity, or paywalled article without the express permission of the author.

Please note, the services and products advertised by our sponsors (by use of terminology such as but not limited to; supported by, sponsored by or brought to you by) in this newsletter carry inherent risks and should not be regarded as completely safe or risk-free. Third-party entities provide these services and products, and we do not control, endorse, or guarantee the accuracy, efficacy, or safety of their offerings.

It's crucial to provide our readers with clear information regarding the inherent nature of services and products that might be covered in this newsletter, including those advertised by our sponsors from time to time. When you buy cryptoassets (including NFTs) your capital is at risk. Risks associated with cryptoassets include price volatility, loss of capital (the value of your cryptoassets could drop to zero), complexity, lack of regulation and lack of protection. Most service providers operating in the cryptoasset industry do not currently operate in a regulated industry. Therefore, please be aware that when you buy cryptoassets, you are not protected under financial compensation schemes and protections typically afforded to investors when dealing with regulated and authorised entities to operate as financial services firm.