- Sporting Crypto

- Posts

- Team Liquid Launches Web3 Fan Engagement Platform; MyBlue

Team Liquid Launches Web3 Fan Engagement Platform; MyBlue

Team Liquid, one of the largest Esports teams, has launched MyBlue, a Fan Engagement Platform built on the Sui blockchain

Thanks to the 5,737 readers exploring where Sports meets Web3. If you're reading this and still haven't signed up, click the subscribe button below!

👥🔍 Sporting Crypto Job Board - Jobs of the week

Visit the Sporting Crypto Job Board today to explore new career opportunities, or to find the perfect fit for your organisation.

Team Liquid Launches Web3 Fan Engagement Platform; MyBlue

Sporting Crypto Newsletter is supported by The HBAR Foundation.

Discussed in this edition of Sporting Crypto:

MyBlue 🔵

a) Overview

b) QuotesOnboarding and Functionality 💻️

a) To Blockchain or not to BlockchainAnalysis & Concluding Thoughts 🧠

a) Esports Pain, Blockchain Gain?

b) Gamer Resistance

MyBlue Overview 🔵

Major Esports team, Team Liquid, is launching a Web3-enabled fan engagement platform called MyBlue. It is built on top of their current former fan engagement platform Liquid+ and built on the Sui blockchain.

Fans can create their own NFT avatar of Team Liquid’s Blue Mascot, which can be customised with digital apparel earned by completing challenges. They can also unlock additional rewards such as; signed jerseys, discounts, in-game currency, exclusive merch and player access and money-can’t-buy experiences. The NFT itself is ‘soulbound’ meaning it cannot be traded.

Steve Arhancet, co-CEO of Team Liquid said:

“We’re excited to launch MyBlue to our fans, as well as the wider esports and gaming communities. Thanks to our partnership with Mysten Labs, we’ve taken the best parts of Liquid+ and upgraded it by integrating Sui to make the ultimate fan platform. Fans show up for us, and MyBlue will enable us to keep showing up for them by offering amazing experiences and unique rewards. I can’t wait for all our fans to get their own Blue.”

Onboarding and Functionality 💻️

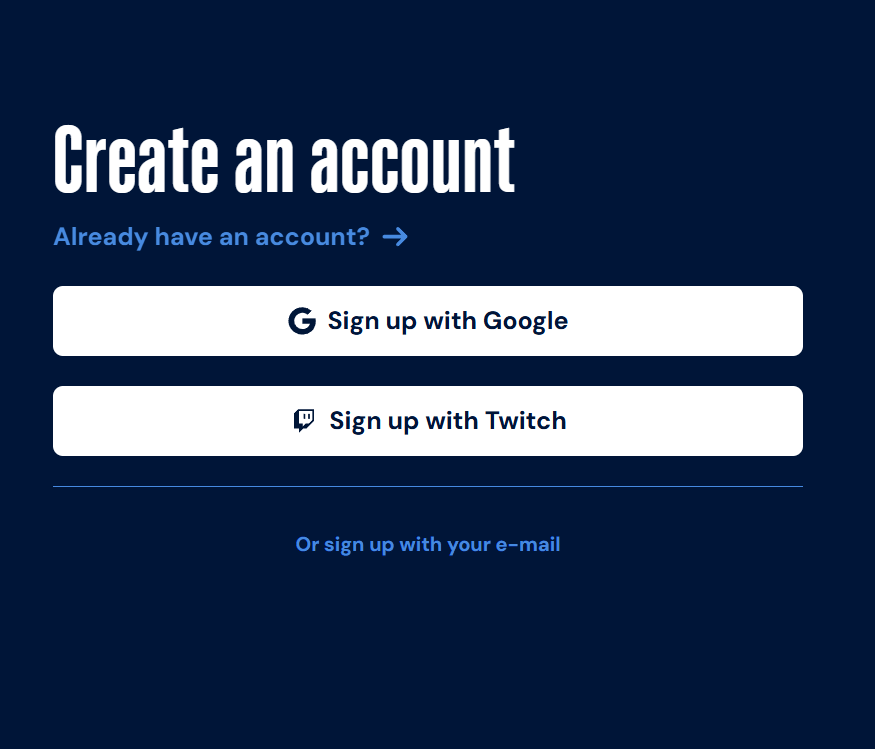

When signing up to the platform, fans can use Email, Google or Twitch details to create an account.

Fans are generated a wallet in the blockchain the background connected to their social login of choice.

Interestingly, when fans ‘choose their experience’ after signing up, they are given the option of whether or not they want the ‘Basic’ experience or the ‘Basic +MyBlue’.

Presumably, this means users who choose ‘Basic’ do not create a wallet in the background, and are limited to the features outlined.

This is perhaps the first time I’ve seen the opt-in happen during account creation. Most blockchain-based activations in entertainment tend to try and incentivise onchain activity after the fact with perks, rewards and discounts.

Analysis & Concluding Thoughts 🧠

Many have pointed to Esports and Gaming as markets in crisis, and when picking the bones and contextualising against lofty pandemic market highs - it is hard to argue with that.

Starting high level, looking at layoffs in gaming — as per Matthew Ball’s essay ‘The Tremendous Yet Troubled State of Gaming in 2024’: In 2022, the industry (Gaming) had a then-record of 8,500 layoffs. 2023 beat that record by nearly 25%. And during the first two months of 2024, there have already been some 8,000 job losses.

Since then, another ~5000 layoffs have been made in the gaming industry, making it the worst year for the gaming job market post-pandemic.

US consumer spending on video games is down 6.3% between 2021 and 2023, and 2023 saw numbers equitable to 2019 in real terms (considering things like inflation).

Mobile gaming has also seen difficulties — with a 6.7% decrease in consumer spending in 2022, and a further decrease of 2% in 2023. There are more games than ever on major app stores, and it is harder to hit strong ‘revenue-per-user-per-day’ numbers when user acquisition costs are so high.

Looking at Esports more specifically, the troubles are well publicised.

David Beckham-backed Esports group ‘Guild Esports’ burned through £26.6 million in three & and a half years, leaving them with a cash position of just £25,000. Their market cap dropped 99% from its debut in late 2020, and have now agreed to be acquired by DCB Sports.

FaZe clan, a professional Esports team and lifestyle brand went public via SPAC in mid-2022, achieving a $725m valuation, before being acquired for just $17m a year later.

So where does Esports find new pockets of value creation?