- Sporting Crypto

- Posts

- SEGG Media's $300m Sports Tokenization Strategy

SEGG Media's $300m Sports Tokenization Strategy

SEGG Media, formerly Lottery.com Inc., announced the launch of its Web3 and Digital Asset Strategy. Who are SEGG Media and what exactly is this?

Join 4750+ Leaders in Web3 & Sports from brands like FIFA, NBA, Premier League, NHL, reading Sporting Crypto every week 👇️

If you’re in London in early November, you need to be at our second instalment of Sports Blockchain Summit.

𝗗𝗲𝘁𝗮𝗶𝗹𝘀:

📅 5th November 2025

🕐 830am - 2 pm

👥 Room full of decision makers at the intersection of sports & blockchain

Get Tickets HERE

Get your tickets to Sports Blockchain Summit London → 5th November 2025!

SEGG Media's $300m Sports Tokenization Strategy

Discussed in this edition of Sporting Crypto:

1) SEGG Media's $300m Sports Tokenization Strategy 📊

2) Analysis & The Data🧠

3) Concluding Thoughts 💬

SEGG Media's $300m Sports Tokenization Strategy 📊

SEGG Media Corporation, listed on NASDAQ as ‘SEGG’, and formerly Lottery[dot]com Inc., has announced the launch of its Web3 and Digital Asset strategy.

In a two-year roadmap, they aim to ‘generate sustainable onchain yield' and ‘accelerate tokenization across sports and entertainment’ as well as ‘embed blockchain infrastructure into its global media ecosystem’.

SEGG Media operate three verticals:

Sports.com: Serves as the global home for sports content, including live streaming, sim racing, football, motorsports, eSports, and original content produced by Sports.com Studios.

Entertainment: Focuses on live experiences, AI-driven event streaming, music media, fashion, and fan engagement platforms, including acquired assets like Concerts.com and TicketStub.com.

Lottery.com: The "ethical gaming engine" which manages international lotteries, iGaming, instant wins, sports betting, and charity-aligned gaming initiatives.

On the sports piece, more specifically, Sports.com Studios entered into a partnership with GOATS Entertainment, a business co-founded by filmmaker Kevin Kaufman and veteran entertainment executive Joe DiMuro. GOATS Entertainment bring the production capability and expertise, but also have an impressive archive of IP — including photography and film interviews with storied athletes.

On the capital allocation side, SEGG Media plans to maintain 80% of its deployed capital as a multi-asset crypto treasury, initially focusing on Bitcoin and generating validator-based income, including Ethereum, Solana , and ZIGChain.

What this means in practice is SEGG Media will buy those crypto assets with 80% of the $300m, staking (locking up and contributing to the network) specific assets to those relevant networks, and earning a yield.

As per press releases:

“The remaining capital will fund strategic acquisitions in sports, media, and gaming, expanding the company's recurring-revenue base, as well as the expansion of tokenization & other Web 3 capabilities”

SEGG MEdia also announced a strategic partnership with ZIGChain, which explains why they are part of the multi-asset crypto treasury.

And going back to sports once again, SEGG Media’s web3 roadmap looks like this, according to Bezinga, who had the exclusive:

“Anchored by Sports.com, the company plans to develop a fully tokenized sports and entertainment ecosystem built on four core pillars, namely Digital Asset Treasury & Validator Yield for sustainable, yield-generating multi-crypto operations, Sports Tokenization Ecosystem focused on tokenized assets enabling fan ownership, athlete IP monetization, and global engagement via ZIGChain, Sports Exchange Initiative allowing fans to trade tokenized teams and sports IP and Strategic Acquisitions involving deployment of validator income into cash-generative assets across sports, media, and gaming.”

Analysis 🧠

First of all, let’s break down why so many listed companies are pivoting to become Digital Asset Treasuries or a ‘DAT’.

They are a new phenomenon in the markets — where a publicly listed company hold much or most of their balance sheet in crypto. They can accelerate the buying process by raising money, by selling shares or issuing convertible notes (debt) to raise capital from investors.

The most famous example of this is Strategy, formerly known as Microstrategy, led by Michael Saylor, who continuously do this to acquire more Bitcoin.

Essentially, for investors, this is a way to get exposure to the underlying asset without owning it, and buying via traditional means. These DATs usually trade at a premium to the underlying asset, but can create a death spiral if they trade at a significant discount for a long period of time.

This is also a way for blockchain foundations and other funds to create demand for specific tokens, without breaking securities laws.

For example, right now, token creators cannot take a portion of revenue from their networks and distribute it to holders, because it would trade as a security.

Instead, many foundations and token creators are installing ‘buyback’ mechanisms, where they use a portion of their revenue to perpetually buy back tokens, to add to their treasury, creating demand for the asset.

DATs create a way of getting around that. You raise capital through share issuance or debt to buy more of the asset.

It’s a quirky thing to your average person, but is actually not too peculiar in public markets, where funds can often be publicly traded based on the underlying assets they own, equities or otherwise.

What is getting weird however, is the random nature of the companies that are becoming ‘DATs’.

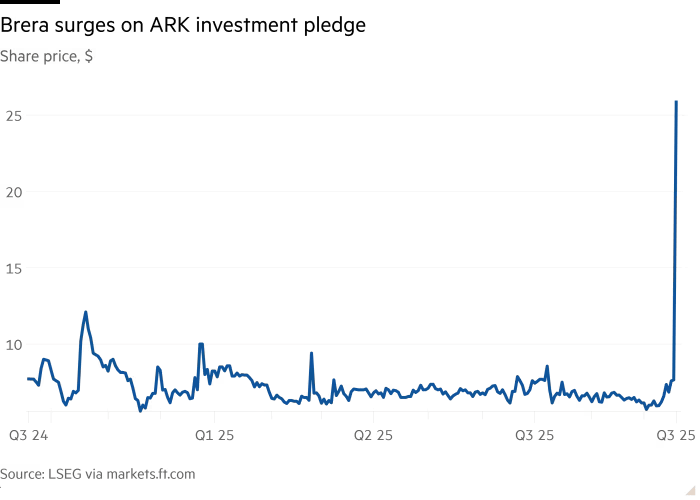

Taking a sports lens — we recently saw Cathie Wood and Abu Dhabi based Pulsar Group pour $300m into Nasdaq listed Brera Holdings, which owns stakes in teams in Italy, North Macedonia, Mozambique and Mongolia, to accumulate Solana tokens

This was the impact…

So SEGG Media are not the first, and won’t be the last, to pivot, or extend the capabilities of a sports-based public business.

Digging deeper into SEGG Media’s pivot, they list 4 key pillars, as already outlined in the newsletter, that will dictate their Web3 strategy.

Digital Asset Treasury & Validator Yield for sustainable, yield-generating multi-crypto operations. This is pretty straightforward. Buy crypto, stake it or lend it, and generate yield.

Sports Tokenization Ecosystem focused on tokenized assets enabling fan ownership, athlete IP monetization, and global engagement via ZIGChain. My bet is this is where ZIGChain have incentivised SEGG Media.

Sports Exchange Initiative allowing fans to trade tokenized teams and sports IP. How they plan on doing this outside of the IP they already own via their partnership with GOAT, I am unsure how they do this.

Strategic Acquisitions involving deployment of validator income into cash-generative assets across sports, media, and gaming. This is interesting, and speaks to the ‘Tether’ model — where they are making a lot of money from their treasury yield and looking to diversify.

Concluding Thoughts 💬

(1) DATS here, DATS everywhere

The DAT phenomenon seems to be peaking. When you have people turning 4th division soccer teams into digital asset treasury companies, we have to be hitting peak euphoria.

(2) The Spillover into Sport could Turn Sour

Doing this to a loud fanbase from a historical club could turn for the worst. We’ve already seen private investments go badly when they involve ‘crypto bros’ — but doing so in the public domain in public markets could be a recipe for disaster.

(3) Tokenizing Sports Assets Requires Incentives

Why tokenize your sports team?

Unless you are a team in desperate need of capital. And most owners do not want fans on the cap table or to be publicly traded. It gives them less flexibility and adds more red tape.

There needs to be an incentive, and right now, there doesn’t seem to be one.

(4) Sports isn’t the big Story, but it Could Become so

On the surface, sports grabs the headline here again.

And because of the excitement around ‘sports as an asset class’ it makes sense from a PR perspective why one would position it in this way.

But digging deeper, this feels like a crypto treasury play, just like most of the others, with the distinguishing feature being that there is a plan to execute a sports-related tokenization play.

But beneath all of this, things are beginning to bubble.

Onchain payments are here and scaling. The tokenization of everything is happening, including equity. Sports teams and leagues are starting to modernise their tech stacks and understand the need for first-party data.

So this intersection feels, like the entire broader industry, primed for an explosion across the board.

More Sports & Web3 Stories

General ‘Stuff’ that Could Impact You

Thanks for reading the latest edition of the Sporting Crypto newsletter!

If you enjoyed this, please tell your friends who might be interested and share it on socials.

Disclaimers

This newsletter is for informational purposes only and is not financial, business or legal advice. These are the author’s thoughts & opinions and do not represent the opinions of any other person, business, entity or sponsor. Any companies or projects mentioned are for illustrative purposes unless specified.

The contents of this newsletter should not be used in any public or private domain without the express permission of the author.

The contents of this newsletter should not be used for any commercial activity, for example - research report, consultancy activity, or paywalled article without the express permission of the author.

Please note, the services and products advertised by our sponsors (by use of terminology such as but not limited to; supported by, sponsored by or brought to you by) in this newsletter carry inherent risks and should not be regarded as completely safe or risk-free. Third-party entities provide these services and products, and we do not control, endorse, or guarantee the accuracy, efficacy, or safety of their offerings.

It's crucial to provide our readers with clear information regarding the inherent nature of services and products that might be covered in this newsletter, including those advertised by our sponsors from time to time. When you buy cryptoassets (including NFTs) your capital is at risk. Risks associated with cryptoassets include price volatility, loss of capital (the value of your cryptoassets could drop to zero), complexity, lack of regulation and lack of protection. Most service providers operating in the cryptoasset industry do not currently operate in a regulated industry. Therefore, please be aware that when you buy cryptoassets, you are not protected under financial compensation schemes and protections typically afforded to investors when dealing with regulated and authorised entities to operate as financial services firm.