- Sporting Crypto

- Posts

- Prediction Market Singularity

Prediction Market Singularity

The lightning rod of conversation for everyone in crypto, sports betting and finance. But where is this headed and where is the value?

Join 5500+ Leaders in Blockchain & Sports from brands like FIFA, NBA, Premier League, NHL, reading Sporting Crypto every week 👇️

👥🔍 Sporting Crypto Job Board - Jobs of the week

Head of B2B Sales @ Sweat Foundation - Link here

Growth Product Manager @ Courtyard.io - Link here

Design Engineer @ Dapper Labs - Link here

Visit the Sporting Crypto Job Board today to explore new career opportunities or to find the perfect fit for your organisation.

Strap in for a long read on prediction markets.

Discussed in today’s Sporting Crypto:

The exploding volumes

The market participants

The Tam

The Product

The consumer

Not all contracts are made the same

Regulation and the bifurcation between speculation and serious business

In the midst of a supermarket marketing battle between Kalshi and Polymarket, the start of 2026 for Prediction Markets (PMs) has been fascinating.

Volumes have grown so large that every financial institution, crypto exchange, and sportsbook is looking seriously at this space:

April 2024: $20M weekly volume

November 2024: $2.5B weekly volume (US election)

January 2026: $6B weekly volume

It’s a gold rush that amalgamates many disparate business types, all competing with one another.

And whilst this feels like a bubble, we have not seen the half of it yet.

CBOE are in talks to bring back “all or nothing markets” to compete with Prediction Markets.

Coinbase launched the fully integrated ‘Coinbase Predict’.

Crypto[dot]com spun out their prediction market product called OG, whilst simultaneously driving B2B2C volumes with Underdog, amongst others.

And Hyperliquid, crypto’s biggest decentralised perpetuals protocol, is also readying an embedded prediction markets feature.

Calling this a gold rush is underplaying it.

Many assumed prediction market volumes would collapse after the 2024 election.

Instead, they've gone parabolic.

Source: Datadashboards via Dune

So, who are the players driving the explosive rise, and how do you categorise them?

1. Prediction Market Businesses

Kalshi and Polymarket built this category.

These are businesses that are B2C, prediction markets-focused, although at times have also gone B2B2C — Kalshi’s partnership with Robinhood is the best example of this.

This category solely serves the prediction market product, and there are many others — Myriad, Limitless, to name a couple.

There are nuances to the approach, business model and level of ‘onchain-ness’, but these businesses are fundamentally Prediction Markets at their core.

2. Crypto Exchanges

Coinbase launched prediction markets to US users in late January 2026, sourcing order flow from Kalshi.

Crypto[dot]com just launched OG, a standalone prediction markets app that will be the first platform to offer margin trading on event contracts — and have also gone B2B2C, powering Underdog’s product and many others.

Gemini launched prediction markets in December 2025.

For crypto exchanges, this is about becoming "everything exchanges" — diversifying beyond spot crypto trading into stocks, derivatives, and now event contracts.

3. Sportsbooks and DFS Operators

FanDuel (Flutter) is partnering with CME Group for its upcoming prediction market launch.

Yep, that’s the CME group, the oldest exchange in America.

DraftKings launched its DraftKings predictions product in December 2025, initially in 38 states.

Underdog partnered with Crypto[dot]com to roll out prediction markets, too.

Smarkets and Matchbook are both redesigning their UI to look and feel like prediction markets rather than exchanges.

Fanatics launched Fanatics Markets.

At this point, not one sportsbook or adjacent business has indicated that they’re not looking at this space seriously, at this point.

Sportsbooks see prediction markets as a way to reach customers in states where traditional sports betting remains illegal. It is regulatory arbitrage right now. But some also see this as a bigger market than just sports gambling, and a way to protect against haemorrhaging customer deposits.

4. Financial Institutions

The biggest signal that prediction markets have arrived is the involvement of traditional financial infrastructure.

ICE (Intercontinental Exchange, owner of the NYSE) took a $2 billion stake in Polymarket.

CME Group has partnered with FanDuel to power its prediction market offering.

Goldman Sachs is reportedly exploring the space.

Robinhood is acquiring LedgerX to gain its own exchange and clearinghouse infrastructure, verticalising, removing the need for Kalshi in the background.

If you think this is just sports gambling, I’m here to tell you you are wrong.

5. Crypto Native Businesses

Isolating this to everything other than exchanges, which, for the most part, facilitate the purchasing of cryptoassets.

Hyperliquid are the best example of this, likely embedding prediction markets into their protocol.

Jupiter, a decentralised exchange on Solana, recently integrated Polymarket.

Crypto wallet Phantom has a Kalshi integration that allows users to trade event contracts via their interface.

The onchain, natively embedded, prediction markets piece of this space is interesting.

They’re either being built themselves or embedded via a third party (e.g. Jupiter and Polymarket).

The TAM 🌐

When you have so many different types of businesses going after the same market, it’s difficult to know:

The TAM

The Customer

and

What is the product is?

Let’s begin with (1) the TAM.

One might think that the starting point is sports gambling, because 90% of Kalshi’s volumes stem from sports wagers, and Polymarkets '~40%.

In the United States, nationwide sports betting handle topped $166 billion in Feb 2026, whilst the global market is valued at ~$600bn.

But are those metrics useful?

Not especially, when the CEO of Interactive Brokers, a $110bn company, said that they are ‘working on approaching’ temperature, electricity and natural gas contracts.

And the CEO of Goldman Sachs, David Solomon, said that Prediction markets are ‘super interesting’, going on to say:

"When you think about some of these activities, particularly when you look at some of the ones that are CFTC regulated, they look like derivative contract activities.”

“So I can certainly see opportunities where these cross into our business.”

When a $110bn and $270bn company, two of the biggest in finance, indicate interest here, you can be sure that they’re not looking at sports wagering.

That is small fry for them.

“We’ll leave it to the FanDuels and the Robinhoods and others that are positioning themselves as gambling firms”

Said the Charles Schwab CEO, Rick Wurster, in a recent interview.

So how do you adjust for the TAM when there is involvement from companies worth more than the entire U.S. sports betting market?

The answer is that it’s really difficult to do, because we simply do not know the extent of the utility that the accuracy of prediction markets brings to the table.

But we do have some directional hints.

We know that it gives professional investors the ability to hedge market exposure (rate cuts, earnings calls, elections and more).

And it stems from how deadly accurate they are.

Prediction Marketsare more accurate than the media, and the closer they get to the finalisation of the event, the more accurate they are.

Indeed, for things that are really difficult to accurately forecast, even in their infancy, prediction markets reign supreme. During the recent storm that hit the East Coast of the U.S., Kalshi was more accurate in predicting inches of snowfall than the National Weather Service.

H/T Alanwu on X

Kalshi's implied forecast (green line) fluctuated between 11 and 13 inches throughout the period, consistently hovering around the eventual outcome.

The National Weather Service (orange line) started at 12 inches, then revised downward multiple times — dropping to 10.8, then 9.7 inches as the storm approached.

By the time snow began falling on January 25th, Kalshi was closer to reality while NWS had adjusted away from it.

This is a small sample size, and weather prediction is notoriously difficult. But it's a useful illustration of what prediction markets can do by using the wisdom of the crowds.

And so to ascertain the TAM of Prediction Markets is very didfciult right now, and any analyst saying they can do so is licking their finger and raising it to the sky.

So let’s take a step back.

There is huge value in the accuracy of the outcome of these markets.

But the reality is that most of the volume right now is being driven by sports trading and wagering.

And whilst we can bifurcate the mechanism by which the outcome is paid out (sportbook = house, prediction market = P2P) — it is fundamentally the same thing.

If you are wagering that a team will win a game, whether the payout is from another customer or a centralised party doesn’t fundamentally matter. Of course, we can argue that sportsbooks limit successful participants, and exchanges are incentivised to do the opposite - because it’s a volume-based business.

The TAM is difficult to pinpoint — but what does a) the sports wagering dominance and b) the deadly accuracy imply for (2) the customer?

The Customer ❓️

This is where we are seeing a split.

There is this wistful idea that Polymarket and Kalshi will take massive market share from sportbooks, but that’s not the case right now and may never be.

I’ll explain why.

Firstly, the UI is fundamentally too complicated for the average sports bettor — even if the ‘Yes/No’ interface from prediction markets is easier to process than a traditional excahnge.

On the left is Fanduel Sportsbook, and on the right is the presidential election winner 2024 order book on Polymarket.

Sports bettors are used to odds being displayed and picking their winner.

If you show the right-hand side to any sports bettor, they won’t know what is going on. And even though all Prediction Markets show ‘Yes/No’ and the percentage outcome is intuitive, the real volume comes from sophisticated traders who know their way around an order book.

Secondly, the type of activity is divergent because parlays are key to sportsbook success (although prediction markets are trying to replicate this).

Parlays (or accumulators in British speak) are multi-leg bets. Your odds are boosted because the probability is lower that multiple of your bets win.

For sportsbooks, around 30% of their bets taken are from parlays, but they account for a huge percentage of revenue in the U.S.

And their popularity is rising, too.

Prediction markets are trying to get in on this action with what they call ‘combos’.

The issue is, this incredibly profitable form of gambling is hard for a prediction market to replicate.

The reason is simple: you need someone to be on the other end of every leg of a parlay. And if those things cross domains (Trump to win and the Seattle Seahawks to win), then market makers who are taking the other side of those legs will struggle. And to boot, liquidity is stretched the more legs there are, and market makers want to be making liquid markets, not making markets so that gamblers can place a parlay.

This is a product built for a centralised party, to underwrite, payout if there is a win, and in the long run always win.

The data backs this up so far.

Per InGame, in 2025 for Kalshi:

“While parlay volume came to $947.8 million, that figure may be misleading, as most Kalshi users can only bet the “Yes” side of a parlay, but the volume data includes both sides. As most parlays are at longer odds, the vast majority of volume in the data comes from institutional market makers.”

This basically means that you can halve the $947.8m number to get a fairer representation of parlay volume. But even then, the fees generated are minuscule when compared to a sportsbook:

“Fees from parlays on Kalshi came to just $3.7 million, a tiny fraction of the volume that a major sportsbook makes from parlays. In states that report parlay revenue, the bets make up more than 50% of sportsbook revenue. At Kalshi, over the final three months of the year, they made up around 2%.”

Fundamentally, even though most of the volume driven on Kalshi, and significant volumes driven on Polymarket, are from sports, they are not seriously encroaching on the most profitable venue of sports wagering that sportsbooks have to offer.

In a market, you need as many market participants and volume to drive the most revenue. If these prediction markets focus on retail bettors, with their current product offerings, they will not get to the figures they require to grow into their valuations.

This raises the question: (3) What is the product?

The Product 📱

If the answer to the question (2), who is the customer, is muddled based on the interface, offerings and data we are seeing from prediction markets. Are they bettors or traders?

Here, there is a bifurcation as well.

And it’s mainly, so far, from sportsbooks, crypto exchanges and brokers (Robinhood) — and they are choosing whether to be embedded or not.

Crypto[dot]com, Underdog and many others have created standalone products for prediction markets.

For Underdog, this makes sense if you are trying to a) drive volume from states you were not previously allowed in due to gambling laws b) protect your existing licenses, and c) ensure there is no cannibalisation of your existing business.

For Crypto[dot]com — it makes less sense on the surface to launch ‘OG’ their standalone prediction market app, considering they already have traders on their existing crypto exchange. But perhaps in their eyes, they are trying to actively pursue the sports gambling segment — and draw a line between the two businesses that is thick enough,

For others — Coinbase, Robinhood, DraftKings, HyperLiquid — they have embedded or are going to embed these products.

That makes sense, because you are offering a trading product to customers who are already used to trading.

This spectrum does raise the question as to whether we can bucket all types of contracts into one, especially when different demographics are using different contract types.

That’s because not all contracts are made the same…

Contracts and Regulation 🤹

⚽ (1) With sports outcomes, there is almost symmetrical data for participants, and almost anyone can build a model. Prediction markets just provide a P2P way to wager on sports, but with a different user interface.

📊 (2) When predicting the price of an asset, this is a derivative. There is already a market there, but prediction markets are just a way to hedge or get exposure to an asset via the price action.

🌐 (3) In examples like the weather contracts (as per above) and media, we are truly seeing a better, more accurate way to spit out information.

At some point, there will be a line drawn between speculative nonsense and what is ostensibly sports wagering redressed, and the incredibly valuable data that is often generated from these markets. You would think, at least.

This leads to what is moulding and driving this market, which is regulation, or lacketherof.

Last week, the general counsel of Coinbase took to X to announce that the Nevada Gaming Control Board tried to get the NV state court to stop Coinbase from offering event contracts, sports or otherwise.

Coinbase CEO Brian Armstrong took to the social platform to defend their move and accuse state regulators of protecting incumbents from competition:

The reality of this is that there is confusion amongst all market participants about the TAM, the customer, the product and how to categorise event contracts, and develop products and businesses for the above.

Regulation, as it falls right now, does not differ between someone betting on the Seahawks to win the Super Bowl and someone hedging their clients’ stock portfolio against an election or earnings call.

How does that make any sense?

Coinbase saying that states are not protecting customers and protecting incumbents is as true as it is false.

Because multiple things can be true:

Sports contracts are competitive to the bottom line of sportsbooks, but not to every product offering they have

Sports contracts vs Derivatives vs ‘truth seeking’ (media, weather, etc.) are to some extent entirely different propositions

The CFTC have sleepwalked into a situation where this market is far too big to incinerate, and like crypto 4 years ago, needs guardrails, rules and customer protections that are appropriate.

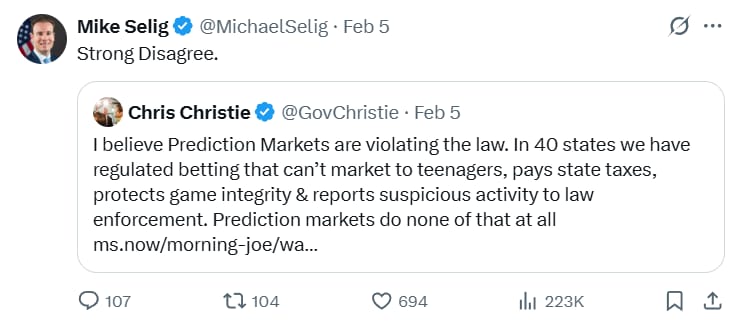

All the while, new CFTC chair Mike Selig says “strong disagree” to the notion that Prediction Markets are violating state law.

We stand in a peculiar place with prediction markets.

It’s quite clear that the end value is extremely valuable in a subset of contracts.

It’s okay that these things could eat market share from sportsbooks, as long as they have the appropriate consumer guardrails (which currently they do not).

The current commentary is so overwhelmingly fixated on sports contracts. And as I come to the end of this 3000-word piece on prediction markets, all of this was essentially distilled recently by Charles Schwab CEO Rick Wurster:

“The first is that prediction markets offer you insights into the probability of different events. As an investor, that information is good to know about.”

On sports contracts: “That’s something we really struggle with and is counter to our mission” — “people generally don’t get better off in their financial life via gambling”

and

“We’ll leave it to the FanDuels and the Robinhoods and others that are positioning themselves as gambling firms”

People are really struggling to see the forest from the trees.

In the short term, the muddled fixation on sports contracts will be resolved, and hopefully with a strong view to consumer protections.

But in the longer term, prediction markets are going to be disruptive, innovative and bigger than 99% of people think across several industries.

There will be a lot of nonsense along the way, but fundamentally, the wisdom of the crowd is incredibly accurate and valuable.

More Sports & Web3 Stories

General ‘Stuff’ that Could Impact You

Thanks for reading the latest edition of the Sporting Crypto newsletter!

If you enjoyed this, please tell your friends who might be interested and share it on socials.

Disclaimers

This newsletter is for informational purposes only and is not financial, business or legal advice. These are the author’s thoughts & opinions and do not represent the opinions of any other person, business, entity or sponsor. Any companies or projects mentioned are for illustrative purposes unless specified.

The contents of this newsletter should not be used in any public or private domain without the express permission of the author.

The contents of this newsletter should not be used for any commercial activity, for example - research report, consultancy activity, or paywalled article without the express permission of the author.

Please note, the services and products advertised by our sponsors (by use of terminology such as but not limited to; supported by, sponsored by or brought to you by) in this newsletter carry inherent risks and should not be regarded as completely safe or risk-free. Third-party entities provide these services and products, and we do not control, endorse, or guarantee the accuracy, efficacy, or safety of their offerings.

It's crucial to provide our readers with clear information regarding the inherent nature of services and products that might be covered in this newsletter, including those advertised by our sponsors from time to time. When you buy cryptoassets (including NFTs) your capital is at risk. Risks associated with cryptoassets include price volatility, loss of capital (the value of your cryptoassets could drop to zero), complexity, lack of regulation and lack of protection. Most service providers operating in the cryptoasset industry do not currently operate in a regulated industry. Therefore, please be aware that when you buy cryptoassets, you are not protected under financial compensation schemes and protections typically afforded to investors when dealing with regulated and authorised entities to operate as financial services firm.