- Sporting Crypto

- Posts

- Kalshi Raise at $6bn, Polymarket at $9bn

Kalshi Raise at $6bn, Polymarket at $9bn

Kalshi have raised $300m at a $6bn valuation, and announced global trading. Polymarket took $2bn in investment from NYSE owner ICE, at a $9bn valuation.

Join 4750+ Leaders in Web3 & Sports from brands like FIFA, NBA, Premier League, NHL, reading Sporting Crypto every week 👇️

If you’re in London in early November, you need to be at our second instalment of Sports Blockchain Summit.

𝗗𝗲𝘁𝗮𝗶𝗹𝘀:

📅 5th November 2025

🕐 830am - 2 pm

👥 Room full of decision makers at the intersection of sports & blockchain

Get Tickets HERE

Get your tickets to Sports Blockchain Summit London → 5th November 2025!

Kalshi Raise at $6bn, Polymarket at $9bn

Discussed in this edition of Sporting Crypto:

1) Kalshi & Polymarket’s Raise 💰

2) By the Numbers 📊

a) Sports Volumes Dominate

3) Analysis 🧠

4) Concluding Thoughts 💬

Look, I didn’t want to write about prediction markets for the second consecutive week, but it’d feel weird not to, considering how big the news was this week.

The Raises

The prediction markets space has just had its biggest week yet, with two of the biggest raises of this year.

Kalshi announced a $300 million raise at a $6 billion valuation, with backing from some of the biggest names in venture capital: Sequoia, A16Z, Paradigm, Capital G (From Google) and notably, Coinbase Ventures.

The raise came alongside news that Kalshi are launching international trading across 140+ countries with a shared liquidity pool. Specific Exclusions include the UK, Australia, France, and Canada — who are not part of the expansion.

Kalshi projects $50 billion in annualised trading volume this year, and claims to hold 60% of global market share in the prediction markets category, after recently overtaking Polymarket. The company also revealed some angel investors, including NBA star Kevin Durant and comedian Kevin Hart.

Their main competitors, Polymarket, also had news of their own. They closed a $2 billion investment from Intercontinental Exchange (ICE) — the owner of the New York Stock Exchange — at a $9 billion valuation.

Less than a year ago, Polymarket founder and CEO Shayne Coplan had his home raided by the FBI as part of a DOJ probe into U.S. access to the platform.

Since then:

Polymarket have acquired QCEX, a CFTC-licensed exchange and clearinghouse, for $112 million, paving their way into the U.S. market re-entry (which is imminent)

They've also brought on Donald Trump Jr. as an advisor, via his investment vehicle 1789 Capital, which made a strategic investment into the company.

The regulatory investigations from the DOJ and CFTC have since formally closed.

Now, they have NYSE owners investing heavily in Polymarket

By the Numbers 📊

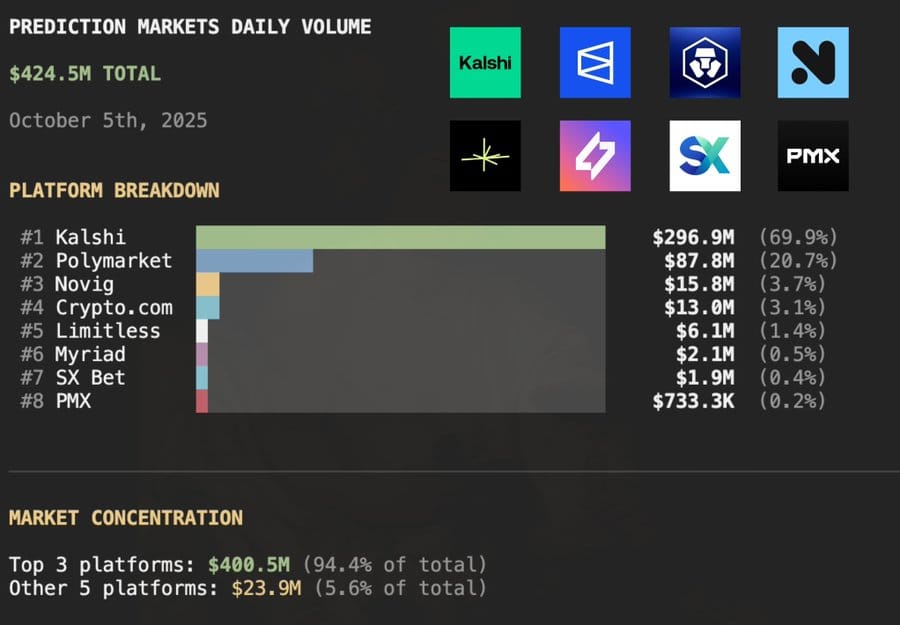

Prediction markets are accumulating approximately~ $500m in daily volume at the time of writing, with Kalshi and Polymarket representing over 90% of that.

Novig, Crypto[dot]com, Limitless, Myriad and other smaller players make up the the rest of the volumes.

In terms of volume on Kalshi and Polymarket, September, coinicinding with the launch of American Football season, saw Kalshi overatke Polymarket to become the market leader, seeing in excess of $200m in daily volume, whilst Polymarket sits at ~$140m.

Source Artemis Analytics

Some have pointed out, however, that outside of sports-related volume, Polymarket still dominates, hoovering up to 85% of all non-sport-related contract volume.

But, in spot volume, Polymarket is still dominated by sports, with up to 60% of volume on the platform specific to the category.

Source Artemis Analytics

Kalshi’s is much higher, with up to 85-90% of volumes coming from sports contracts.

Source Artemis Analytics

Digging deeper into subcategories on Polymarket, Basketball, Soccer, Baseball, American Football and Ice Hockey have dominated over the past 12 months.

To Summarise:

Kalshi have overtaken Polymarket as the dominant prediction market

BUT… It’s because they have leaned heavily into sports…

BUT… so have Polymarket, although their volume is much less concentrated

Concluding Thoughts 💭

(1) The investors give us signal

Polymarket are still seeking the legitimacy and cleaner onshore regulated image that Kalshi have worked hard to build. The owner of NYSE certainly helps that.

For Kalshi — Paradigm backing them once more, alongside Coinbase Ventures — gives more credence to the idea that they will one day be an onchain platform.

(2) But it also feels like a fork in the road

In the last 3 months, Kalshi have chased hard after sports volume — truly finding product market fit there. Polymarket on the other hand, see large volumes on a broader variety of categories.

Chasing that volume, however, whilst a big opportunity to disrupt gambling companies, feels like a race to the bottom. Sharp money, market makers, arb traders — this doesn’t make consumers feel like they have an edge. It’s unlikely for example, that Kalshi will have a strong parlay product as sportsbooks do, considering they were built for a centralised party to price. Kalshi have seen $10m in parlay action since launching 2 weeks ago (but let’s call it $5m as it needs volume on both sides) — but how scalable will this be? And what are the margins compared to a traditional sportsbook?

(3) The lines are blurring

NYSE is investing in Polymarket

Fanduel and CME are launching a prediction market together

And Robinhood are rolling out a new iOS dashboard that has football prediction markets, crypto and stock earnings all on one page.

(4) Is it gambling (?)

Yes and no, but what is becoming clear to me is that this is a much, much bigger market.

As Vlad Tenev, Founder of Robinhood, said “the car disrupted the horse and carriage”

I think it’s naive to think this is just gambling re-skinned. It’s much bigger, and going to be much more impactful across all industries.

(5) Aggregating liquidity is BIG for Kalshi

Especially when supposedly, Polymarket will not be doing that with their U.S launch.

I do expect however, this will land them into much more legal trouble. They will be fighting regulators across the planet for months and years to come, I’m sure.

(6) And they have the upper hand in B2B2C

Kalshi also have the upper hand with their B2B product, with their flagship partner Robinhood. I’m sure they will try and double down on this, as their head of crypto, John Wang was recently quoted saying that they want to plug into every crypto consumer app over the next 12 months. How realistic this is, remains to be seen, especially as they have big competition from the likes of Crypto[dot]com amongst others.

(7) The elephant in the room

Crypto.

What will Polymarket’s token look like and how will it impact volumes?

When will Kalshi transition to being an onchain business, and how will that alter their costs and better their ability to aggregate liquidity?

(8) This is the next big partner for sports

Both of these companies will advertise at the Super Bowl, I’m fairly sure of it.

They are already both massively leveraging sports, and that will continue.

It’s a matter of time before they sponsor teams, leagues and stadiums over the next 18 months

More Sports & Web3 Stories

Sorare is moving to Solana (Read more here)

Super Rugby nabs ‘multimillion-dollar’ Swyftx crypto title deal in Australia (Read more here)

AC Milan Extends Web3 Partnership with Socios (Read more here)

FIFA’s Blockchain-Based Ticketing System for 2026 World Cup Faces Preliminary Probe (Read more here)

General ‘Stuff’ that Could Impact You

Thanks for reading the latest edition of the Sporting Crypto newsletter!

If you enjoyed this, please tell your friends who might be interested and share it on socials.

Disclaimers

This newsletter is for informational purposes only and is not financial, business or legal advice. These are the author’s thoughts & opinions and do not represent the opinions of any other person, business, entity or sponsor. Any companies or projects mentioned are for illustrative purposes unless specified.

The contents of this newsletter should not be used in any public or private domain without the express permission of the author.

The contents of this newsletter should not be used for any commercial activity, for example - research report, consultancy activity, or paywalled article without the express permission of the author.

Please note, the services and products advertised by our sponsors (by use of terminology such as but not limited to; supported by, sponsored by or brought to you by) in this newsletter carry inherent risks and should not be regarded as completely safe or risk-free. Third-party entities provide these services and products, and we do not control, endorse, or guarantee the accuracy, efficacy, or safety of their offerings.

It's crucial to provide our readers with clear information regarding the inherent nature of services and products that might be covered in this newsletter, including those advertised by our sponsors from time to time. When you buy cryptoassets (including NFTs) your capital is at risk. Risks associated with cryptoassets include price volatility, loss of capital (the value of your cryptoassets could drop to zero), complexity, lack of regulation and lack of protection. Most service providers operating in the cryptoasset industry do not currently operate in a regulated industry. Therefore, please be aware that when you buy cryptoassets, you are not protected under financial compensation schemes and protections typically afforded to investors when dealing with regulated and authorised entities to operate as financial services firm.